Queuing for bones. Huge queues for donations of bones to families in need have spread across Brazil since 2020, especially in Mato Grosso, in the Brazilian Cerrado, a symbol of the strength of agribusiness, with the largest cattle herd in Brazil totalling 32 million animals. Photo: Bonito - MS municipal prefecture.

In 2022, the world faced the highest inflation rates seen in 40 years, but price inflation on food products was even higher. In March 2022, the FAO’s food price index registered an all-time record (159.7) and, although the international price of food has been falling, it remains at its highest ever levels.

Interruptions in supply chains have been blamed for this spike in prices, firstly due to the pandemic, then the war in Ukraine and disruptions in the supply of oil, gas, fertilisers and staple goods, such as flour, maize and sunflower; in addition to the recurrence of extreme weather events that have been compromising food production around the world.

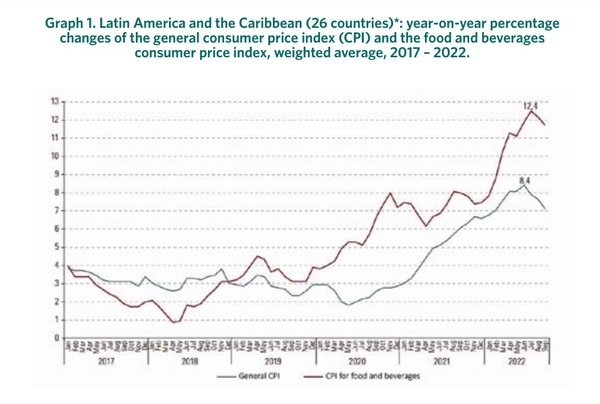

However, even with adequate food production and stock levels that meet global demand, along with the fall in the international price of oil and gas between 2020 and the start of 2023, the general food price index remains 14% higher than in 2021. In the major Latin American economies, the inflation rate on food products ended 2022 more than double that of other consumer products (See Table 1 below). The average increase in the food price index in the region over the last 12 months reached almost 12% in September 2022, compared with a general inflation of 7% (See Graph 1).

This means that the food price crisis is not rooted in a shortage of food and supplies; rather it is a structural crisis of the global industrial agrifood system itself, which is highly concentrated, financialised and ultra-specialised.

The current industrial food system has proven to be highly inefficient in addressing the energy, health, ecological, and food-related challenges of our time. This system relies heavily on the use of oil and gas, due to its dependence on large volumes of pesticides and fertilisers used in extensive monocultures of agricultural commodities and the need for long-distance transportation. As a result, the industry has created a costly and extractive farming industry that specialises in producing food from a narrow range of grains and protein sources. This approach has led to the creation of depletion zones that exhaust valuable resources, including fertile soil, water, and biodiversity, while exploiting a vulnerable workforce and draining public funds. Furthermore, this industry has opened up consumer markets that are highly reliant on imported supplies or food.

Due to the fact that industrial production, processing, and distribution are largely controlled by a small number of corporations and investors, any increase in the cost of production - whether due to a pandemic, war, or climate-related events - can quickly translate into higher prices for entire countries, as well as for those involved in both the production and consumption of food. As the international price of agricultural commodities and food rises, so too does the stake of investors in land and the broader industrial agri-food chain. Unfortunately, this process creates a vicious cycle that fuels speculation. The rise in food prices becomes disconnected from both production and supply, while simultaneously putting upward pressure on the price of land and other production factors.

According to a report by the ETC Group, as of 2020, three of the world's largest asset management firms, namely US-based State Street, Vanguard, and BlackRock, collectively controlled over 25% of the shares in some of the largest agri-food corporations at each stage of production.[1] Therefore, the financial roulette gamble is still on grabbing of large swathes of land to increase the production of a short list of agricultural commodities that underpin impoverished industrial food systems – all at a very high economic, social and ecological cost. The global industrial agri-food chain is one of the epicentres of multiple crises.

Source: Economic Commission for Latin America and the Caribbean (ECLAC), based on official data. Not including Argentina, Cuba, Haiti, Saint Vincent and the Grenadines, Saint Lucia, Suriname or Venezuela (Bolivarian Republic of).

Hunger business and record profits

Latin America is the world's largest net food exporting region, but 4 in 10 people live with moderate or severe food insecurity, compared to 1 in 10 worldwide. Eight per cent of all people suffering hunger on the planet live in the region (56 million of a total of 768 million people), according to FAO, 2022. In 2022 in Brazil, a major global exporter of soya, maize, beef and poultry, over half of its population were living with some degree of food insecurity (58.7%), and 33 million people were suffering hunger (Rede PENSSAN, 2022).

Above all, food inflation affects the incomes of the poorest families in the region, who spend on average 40% of their income on food and energy. This is a crucial factor that exacerbates poverty, food insecurity and hunger. Extreme poverty affects almost 82 million people and 1 in every 5 people is not able to afford a healthy diet, as it has become the most expensive region in the world to eat healthily, exacerbating the existing deep social inequalities between countries in the global North and South and within countries.

Meanwhile, fertiliser corporations such as Yara y Nutrien, and seed and pesticide corporations such as Bayer and Basf, had higher profits by July 2022 than in the whole of 2021.[2] Seed and pesticide corporations like Bayer/Monsanto (Germany), Syngenta/ChemChina (Chinese), Corteva (Dow and Dupon merger - USA) and Basf (Germany) have doubled their profits in the last five years. In the early 1980s, seed companies were mostly family-owned and accounted for less than 1% of the global market. However, due to the consolidation of these companies into the chemical industry and the subsequent control of intellectual property over both seeds and pesticides, as of 2020, only four corporations had acquired control over 50% of the world's commercial seeds and 62% of the pesticide market.

Cargill, the largest grain trading company in the world, reported its highest profit in 156 years of U$ 5 billion. Moreover, the other few companies that buy, process and transport grain (such as China's Cofco, North America's ADM and Bunge, and France's Dreyfus) expanded their global sales by 15% between 2017 and 2020, despite higher operating costs.[3] They are able to profit in three ways by controlling purchases of industrially produced grains: first, by driving down prices for producers; second, by selling commodities in dollars at an inflated exchange rate; and third, by driving up international prices.

Agri-Food Conglomerates: major actors that destabilise democracy and popular sovereignty in Latin America and the Caribbean (LAC)

Historically, Latin American and Caribbean countries have typically implemented policies related to land use, foreign exchange, taxation, environmental regulations, and labour practices that prioritised the interests of the extractive mining and agri-food industries inherited from their colonial past.

Half of the land in the region is in the hands of 1% of large and medium-sized rural landowners, much of it obtained through illegitimate means. The historical devaluation of their currencies and the low taxes on commodities, encourage most of the output from these lands to be exported. LAC is one of the largest consumer markets for these corporate inputs: transgenic seeds (soy, maize and cotton), agrochemicals (such as glyphosate), as well as being the most fertiliser-dependent region in the world, importing 85% of the fertilisers they use. In Brazil, the turnover of agribusiness corporations increased by almost 35% in 2021, with the largest increase in the agrochemicals and inputs sector (49%). The Bolsonaro government approved more than 2,000 pesticides in 4 years of government, an all-time record.

Since the 1960s, the North American "war on hunger" has allocated its own public budget and that of the Latin American dictatorships (at the expense of their debt cycle) to finance the entry into the region of today's major transnational food corporations such as Monsanto, ADM and Cargill, and distribute seeds, pesticides and fertilisers for the so-called "green revolution", under the guise of “humanitarian aid to starving nations”. During the current crisis, significant amounts of public funds are being allocated to agricultural aid packages, including tax exemptions on import-export, subsidies, and rural credits for the purchase of inputs and new "technological solutions," which largely benefit large producers and a few transnational corporations from the global North. As a result, these actors are increasingly taking over food production in the region, with private finance playing a major role in this state-driven endeavour.[4]

For a large number of the states in the region, these include loans from the IMF, World Bank, development banks and private banks and investors taken out to combat the effects of the pandemic. Latin American countries increased their debt by 70% of GDP between 2019-2020, making the region the most indebted in the developed world. Over 60% of IMF loans in 2021 were for LAC countries, while between 2019 and 2021, the World Bank allocated U$ 300 million per year to agricultural development programmes. The more states increase their debts in high interest rate and inflationary scenarios, the greater the power of unelected representatives of the financial markets, primarily bondholders, who can use their position to usurp political power in order to dictate the course of macroeconomic policy.

The increasing public debts in the region are making the states vulnerable to Free Trade Agreements and other agreements used by major economies, companies, and investors to advance the region's colonial integration, which undermines democratic processes and popular sovereignty. As a result, there has been a social backlash that has led to the election of so-called "progressive governments" committed to promoting democratic processes and income distribution. However, these governments face strong resistance from those who benefit from the status quo, particularly the agribusiness sector and the industrial agrifood chain. In Brazil, agribusiness interests are accused of dominating the political system, a situation referred to as "Agro é golpe" (agro is a coup), and they have been associated with violent and anti-democratic movements in the country.

Stifling of family and peasant farming and soaring prices of fresh produce

The industrial agri-food complex's control over the prices of agricultural commodities and foodstuffs is not limited to the short list of cereals and proteins traded on stock exchanges. Its influence extends to the production and distribution methods used by peasant networks and family farmers to bring food to market.

The accelerated expansion of single-crop farming results in an increase in the general cost of production, from the price of land and rent, credit and rural insurance to machinery, packaging, transport and labour. This pushes some of the non-capitalised family farmers to migrate to other crops or abandon their land, reducing the areas set aside for the production of fresh and regional food, such as fruit, vegetables and pulses, adding inflationary pressure on these products.

Unlike the "public-private partnership" that sustains the agri-food industrial complex, family farmers and peasants - who produce most of the fresh food with low dependence on external inputs - received minimal state aid during the pandemic. Climate issues, the reduction of farmland and budget cuts in family farming policies, as well as the stifling of food distribution outlets for peasant networks during the pandemic caused fruit, pulses and vegetables to incur the highest price increases of all food products analysed in the Latin American countries (See Table).

In June and July of 2022, a national strike led by Indigenous peoples and peasants in Ecuador was prompted by a surge in fuel prices. This sudden increase had a significant impact on production costs and highlighted the unequal trade-offs between peasant production and industrialized production. As a result, many of these smaller-scale food producers faced significant economic challenges, which ultimately led to the widespread protests and demonstrations seen during the strike.

During the pandemic, food distribution through large "sanitised" supermarkets was considered an essential activity that could not be restricted by lockdowns. On the other hand, open markets, where family farmers and peasants sell their produce directly or without large-scale intermediaries, were closed and criminalised, along with small shops and local businesses which suffered severe restrictions. While trucks, warehouses and large retail chains operated without restrictions, family and peasant farming producers had to look elsewhere for alternatives, as they could not cover the high costs of selling their food in supermarkets. Sales via supermarkets are dominated by large producers, to supposedly guarantee a lower end price to the consumer, whilst large retailers squeeze the farmers. Leaving small producers with two choices: go big or go bankrupt.

The low supply of fresh produce due to the closure of open markets and the increase in production costs has raised the price of these products across marketing channels. This increase, in turn, has been limiting the market to medium and large producers, and exports, mainly of fruit, are now a means of paying the high production costs. This is already a new export market in several countries in the region, including large commodity exporters such as Brazil.

While marketing channels and price statistics may present a certain narrative, the reality is quite different. Peasant and Indigenous production and economies, and their community fabric of sharing seeds and food, are what ensures the survival and health of farming communities across the region, as documented in Profits, Privileges, Control and Repression, 2020. In their livelihood circles and outside of supply chains, a large number of pulses, maize, fruit and vegetables are not accounted for because they flow through their own distribution channels. Trade is often conducted through bartering, or at no cost or as solidarity actions including food donations to vulnerable families on the outskirts of cities, thereby reinforcing a sense of unity between the countryside and the city.

Supermarket and ultra-processed food pandemic

On the other hand, inflation on ultra-processed products in 2022, sold by large supermarkets, was considerably lower, which means that for the first time in history, in countries like Brazil, their prices, on average, are cheaper than fresh products. And this heralds another great crisis, a public health crisis, especially among the poorest sectors of the population.[5] Recent research revealed that in 2019 in Brazil, there were 57,000 premature deaths - between the ages of 30 and 60 - associated with the consumption of ultra-processed foods, this is more than the number of homicides recorded that year.

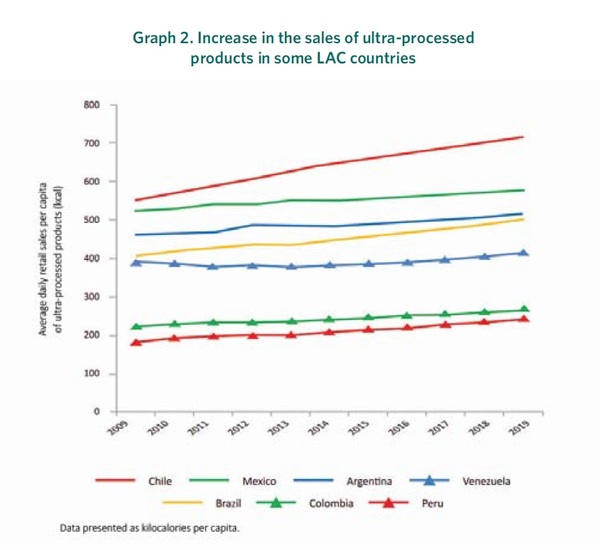

Since the 1990s, many of the ultra-processed products have enjoyed tax exemption and have become widespread in the homes of poorer families because they have been introduced as items in the basic food basket - such as chocolate bars, instant noodles, dairy drinks and sausages - which is not usually the case with fresh and regional products. Between 2000 and 2014 daily sales (in kilotonnes) of ultra-processed products increased by 726% in Latin America (from 53.4 kg to 441.2 kg daily) (See Graph 2).[6] By 2020, the world's top 10 food and beverage processors like Pepsico (US), Nestlé (Switzerland), JBS (Brazil), Tyson Foods (US), Coca-Cola (US) and Danone (France), captured a sales market of US$445 billion.

Source: ECLAC, FAO, WFP. Towards sustainable food and nutrition security in Latin America and the Caribbean in response to the global food crisis. December 2022, p. 10. Available here: https://repositorio.cepal.org/bitstream/handle/11362/48532/1/S2200783_en.pdf

In many Latin American countries, the policy of price reduction has focused on granting benefits to large supermarket chains instead of supporting public purchases from family farmers and expanding strategic public food stocks.[7] The Mexican government - which has seen the highest food inflation in 22 years - has entered into agreements with 15 major food production and distribution companies, including Walmart, granting a "single, universal" license that exempts them from sanitary controls, import taxes and tariffs on all food products (mainly ultra-processed), not just the basic items in the food basket. This is being justified as a means to "control" prices, but these are "prices that the companies had already increased before the agreement". This makes hunger a great business deal.

In addition to direct government subsidies to the food industry, it is important to analyse the extent to which programmes to help the most vulnerable families through food vouchers or food cards (as well as boosting the banking and financialisation of these families), once again hand over public money to the corporate hunger business. In the United States, the Supplementary Nutritional Assistance Program (SNAP) offers subsidies on food purchases in partner shops or supermarkets that accept payments by EBT (Electronic Benefit Transfer) card. The major chains that offer the possibility of online payment for purchases using this card include Walmart, Amazon and Kroger, one of the largest supermarkets in the US and the world. The Argentina Plan Against Hunger also offered monetary support from the banking system, through a card for the exclusive purchase of food in registered establishments. According to the programme's analysis, 61% of the beneficiaries state that they shop in small neighbourhood shops, 58% shop in small neighbourhood supermarkets and 43% prefer large supermarket chains. The survey also showed that major supermarkets accept the card more regularly than other small neighbourhood establishments, due to financial service fees.

The 10 largest retail supermarkets in the world increased their sales by 5% between 2018 and 2020, and control 11% of global consumer spending on edible products, about $8 billion, a 4% increase in global spending compared to 2018.[8] Walmart controls a third of this market.

People’s sovereignty over food production and distribution

Although countries importing food and supplies may feel the impacts of war more directly, it is the extent to which a few corporations and investors have captured food systems that should be considered to gauge the causes and shape possible solutions to the food issue.

In regions with less industrial and financial control of food networks, such as the Caribbean, one of the sub-regions most affected by hunger due to its position as a food importer, the main policies, according to ECLAC/FAO 2022, have been aimed at encouraging the production and consumption of local foods, with support for open markets and short circuits. Today it is the region with the smallest increase in the number of people facing food insecurity. On the other hand, in South America, where a significant part of the economy is dominated by agri-food conglomerates, most policies have focused on tax cuts, subsidies, public credits and private investment for agribusiness and large supermarket chains. However, despite being the world's largest exporter of soy, maize, beef and poultry, the region has experienced a doubling in the number of people suffering hunger since 2015, making it the sub-region with the highest increase in food insecurity across Latin America and the Caribbean (FAO, 2022).

The IMF, World Bank, FAO, WTO and the Food System Summit continue to preach their old playbook of free markets against strategic public stock policies, export limits and price regulation. They call for more public-private partnerships to leverage investments in technological innovations for agriculture and logistical infrastructure to increase food production and exports.[9] The old free-market strategy is now joined by an increase in loans for income transfer policies and the granting of subsidies, either for producers to buy imported supplies or for the most vulnerable families to buy cheaper food (increasingly ultra-processed).This approach involves the poorest families in the hunger business. The revived "war on hunger" once again wants to finance agri-food corporations in order to take an increasingly large slice of the food production and distribution process.

At a time of crisis for civilisation as a whole, crucial measures are called for to ensure our very survival. These involve ending speculation on food products, prohibiting the negotiation of future contracts on agricultural production on stock exchanges and ending patents and other monopoly rights on seeds and other common goods, such as water. Furthermore, it is essential to dismantle the oligopoly over the entire agri-food chain and cancel the external debts of developing countries.

Peasant food networks have historically proven themselves to be the most resilient in facing highly difficult situations. There are almost three billion Indigenous and peasant farmers, urban producers, fisherfolk and pastoralists, who not only feed the equivalent of 70% of the world's population using less than 30% of the world's land, water and agricultural resources, but who also create and conserve most of the planet's biodiversity. This appears to be humanity's best defence. Twenty-five years ago Via Campesina Internacional called it food sovereignty. It continues to be discredited and attacked because it puts the whole hunger business in check.

| Food inflation in key Latin American countries | ||||

|---|---|---|---|---|

General inflation % (annual variation IPCA - 2022)* | Food inflation % (annual variation IPCA - 2022) | Inflation by food type (annual variation IPCA - 2022) | Source | |

Argentina | 94.8 | 95 | Key points include the increase of inflation on fruit (on average 122%), and vegetables, tubers and pulses (on average 168%). Mineral waters, soft drinks, and fruit juices have also increased. | Consumer Price Index -INDEC. https://www.indec.gob.ar/uploads/ informesdeprensa/ipc_01_23891D383E4F.pdf |

Brazil | 5.79 | 11.64 | Higher increase on pulses - 40%; Fruit - 24%. Flour - 22%, bakery products - 20%, milk and dairy products - 22% vegetables - 13% and sugars - 10%; | National Broad Consumer Price Index - IPCA of the National System of Consumer Price Indices - SNIPC https://sidra.ibge.gov.br/tabela/7060#/n1/all/n7/all/n6/all/v/69/p/202212/ c315/all/d/v69%202/l/,p+t+v,c315/resultado |

Chile | 12.8 | 24.7 | Higher increase on fruits - 5.6% (apple -17.7%) and mineral waters, soft drinks (4.8%) and fruit juices (3.4%) | Consumer price index. INE.https://www.ine.gob.cl/docs/ default-source/%C3%ADndice-de-precios-al-consumidor/boletines/ espa%C3%B1ol/2022/ bolet%C3%ADn-%C3%ADndice-de-precios-al-consumidor-(ipc)- diciembre-2022.pdf?sfvrsn=40a36f40_4 |

Colombia | 13.12 | 27.8 | Higher increase on the price of rice (54%) and beef (20.2%) | Consumer price index. DANE.https://www.dane.gov.co/files/investigaciones/boletines/ipc/ pc_rueda_prensa_dic22.pdf |

Ecuador | 3.74 | 7.6 | Products with the highest increase: fruit (oranges 21%, green bananas 9%, tangerines 8%), peas (15%), string beans (5%). (Monthly variation) | Consumer price index. Instituto Nacional de Estadística y Censos (INEC). https://www.ecuadorencifras.gob.ec/documentos/web-inec/Inflacion/ 2022/Diciembre_2022/ Bolet%C3%ADn_t%C3%A9cnico_12-2022-IPC.pdf |

Mexico | 7.82 | 14.14 | Biggest increases were on livestock products (11.5%), agricultural products (9.5%) and vegetables and fruit (7.22%). In 2021 the increase on fruit was 21.7%. | National Consumer Price Index: Índice nacional de precios al consumidor.Inergi. https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2023/ inpc_2q/inpc_2q2023_01.pdf |

Peru | 8.56 | 15.22 | Largest increases on greens, vegetables including potatoes and other tubers - 7.0%. | Variation in the economy’s price indicators. INEI.https://m.inei.gob.pe/media/MenuRecursivo/boletines/ 01-informe-tecnico-variacion-de-precios-dic-2022.pdf |

* The consumer price index refers to the variation in prices in December 2022 compared to December of the previous year.

[1] ETC Group, Food Barons 2022: Crisis Profiteering, Digitalization and Shifting Power, September 2022. The report reveals who controls each step in the global industrial food chain, from seeds, pesticides, fertilisers, farm machinery and even grain processors, food and beverages and supermarket chains.

[2] Data collected by GRAIN in Financial Reports up to July 2022 of companies and data from S&P Capital IQ.

[3] Comparative data from the ETC Group's reports Plate Tech-Tonics: Mapping Corporate Power in Big Food. November 2019, p. 20-21 and Food Barons. 2022, p. 100-101.

[4] Between 2013 and 2018, U$ 540 billion per year in state subsidies were earmarked for industrial farming. A multi-billion-dollar opportunity. Repurposing agricultural support to transform food systems. FAO, UNEP and UNDP, 2021.

[5] Internal documents from Nestlé, the world's largest food company, acknowledge that more than 60% of its products - from chocolates and sweets to breakfast cereals and ice cream - do not meet the criteria to be considered healthy and that some of the food and drink categories it produces "will never be healthy, no matter how much they are revamped". The Financial Times.

[6] Comparison between the two latest reports on ultra-processed food in Latin America 2018 (p.16) and 2019 (p.11). Ultra-processed food and drink products inLatin America: Trends, impact on obesity, policy implications. Pan American Health Organization and the World Health Organization. 2018https://iris.paho.org/bitstream/handle/10665.2/7699/9789275118641_eng.pdf. And Ultra-processed food and drink products in Latin America: Sales, sources, nutrient profiles, and policy implications. 2019. https://iris.paho.org/bitstream/handle/10665.2/51094/9789275120323_eng.pdf?sequence=5&isAllowed=y

[7] Mercosur has authorised its members to reduce the common external tariff (CET) on several imported products by 10% from July 2022. On the other hand, unlike Asia and Europe, the Americas are increasingly reducing public procurement for storage of basic grains that can guarantee a minimum price for farmers and consumers in the face of market fluctuations. See the list of policies adopted by countries around the world in the FAO Report. Food Outlook Biannual Report in Global Food Markets. November 2022.

[8] Comparative data from the ETC Group's reports Plate Tech-Tonics: Mapping Corporate Power in Big Food. November 2019, p. 30 and Food Barons, p. 129

[9] The proposals are in the FAO, ECLAC and WFP Report. Towards sustainable food and nutrition security in Latin America and the Caribbean in response to the global food crisis, December 2022. https://repositorio.cepal.org/bitstream/handle/11362/48532/1/S2200783_en.pdf