Close-up of Chinook salmon in a fish hatchery holding tank 2019. Photo iStock - Adri

The people of Calp, a town in the Spanish autonomous community of Valencia, have been fighting to block the creation of a 50 hectare, mega fish farm just off of their coast. They say it will jeopardise the local tourism industry and put the area's environment and small-scale fisheries at risk, while providing minimal benefits for locals.[1]

Even the mayor of Calp, Ana Sala, is fiercely opposed to the project. In August 2022, in a meeting with the company behind the project, she told them, "What you want to set up here is abominable and it is our obligation to defend our municipality and its interests. Accordingly, we will continue to fight against it."[2]

The company behind the project is Avramar, the largest aquaculture company operating in the Mediterranean sea. But Avramar is no local company. It is owned by the Wall Street private equity firm Amerra Capital and the Abu Dhabi sovereign wealth fund Mubadala Investment. Since Amerra first acquired the company in 2016, Avramar has been on an expansion binge. Some of that expansion has taken place off the coast of Valencia, including one super-sized fish farm that stretches across 144 hectares near El Campello, but most of the expansion has occurred in Greece.

Greek marine aquaculture has surged over the past two decades, and the country is now the main supplier of farmed fish to the rest of Europe. In the 1980s, only 2 percent of fishery products came from aquaculture; today it accounts for two-thirds. The initial growth was driven by small- to medium-sized Greek family aquaculture operations. But, more recently, investment has come from private equity funds, eager to make profits through a consolidation of the industry. One of the first private equity deals occurred in 2006, when an Athens-based private equity firm, Global Finance, took over the fish farm operator Andromeda. Ten years later, after a major expansion of the company within and outside of Greece, Global Finance sold it off to Amerra. Over the next three years, with backing from Mubadala, Amerra acquired two other large Greek fish farming companies, both of which also had farms in Spain, and merged them to form one massive company, Avramar.

When Avramar was formed, the EU Commission's Competition Directorate ruled that it had to sell off about 20 percent of its farms.[3] But this only opened the door to another private equity firm, the Luxembourg-based Diorasis, to buy up the farms and quadruple its aquaculture production.[4] Diorasis is backed by a group of Greek diaspora businessmen and, according to Greek media, Bill Gates.[5] Together, Avramar and Diorasis now control over two-thirds of Greece's fish farming industry and, despite opposition from coastal communities, they are intent on expanding further.[6]

Where the cash is flowing

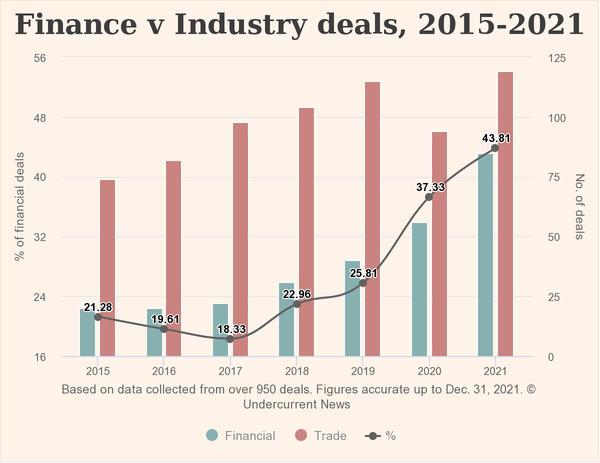

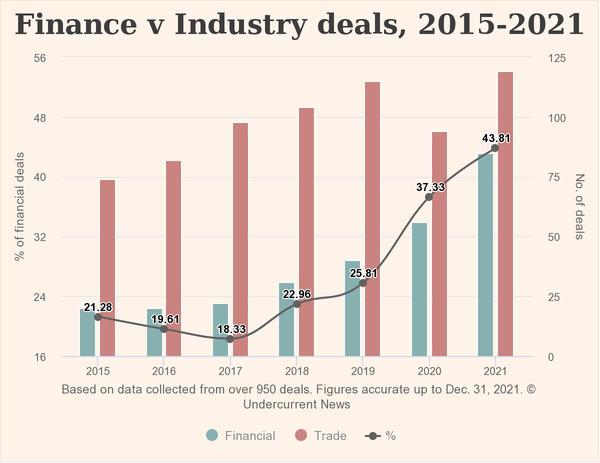

Greece and Spain are not the only places where private equity funds are aggressively moving into the seafood sector. Undercurrent News has been tracking the involvement of private equity funds and other financial players in the sector since 2015. They say that the number of deals by financial players is growing -- and in 2021 accounted for over 43 percent of all 194 deals within the sector that they identified.[7]

Graph 1. Share of total merger and acquisition deals in the seafood and fisheries sector by financial companies (finance) and by corporations from within the sector (industry).

Source: Undercurrent News

Using Undercurrent News as a basis, we identified 41 investment deals by private equity groups in the seafood and fisheries sector since 2019 (see Annex I).[8] This is not a complete picture of private equity’s rising involvement in this sector, but it does provide a portrait of the scale and focus of their investments, from which we can draw a few conclusions:

1. Private equity funds are investing in all parts of the sector, including fishing vessels, seafood processing, retail, aquaculture, fish feed, genetics, technology, waste management and transportation.

2. They are buying up companies in all parts of the world, on all continents, even though most of the private equity firms are based in the US and Europe.

3. They are generally focused on buying up medium-sized companies and then consolidating them, horizontally and vertically.

We can also say that most private equity funds are focussed on aquaculture. This is not surprising. Aquaculture is the fastest growing segment of the industrial food system. International bodies like the UN Food and Agriculture Organisation actively promote it, while governments churn out subsidies and policy measures to sweeten the deal for private investors. It is also a sector that, as noted by the Transnational Institute and FIAN, has been "historically dominated by relatively small or medium-scale players, with tens of thousands of producers (including producers of fish feed) scattered across the globe." All these factors make it, in the eyes of private equity, ripe for consolidation.[9]

Feed production is perhaps the easiest target for consolidation in the aquaculture sector. This is where a number of big corporations, such as grain trader Cargill, are making their moves. Genetics and aquaculture technology/equipment are other areas where corporate control is advancing rapidly, with the active involvement of private equity. But many private equity funds also have their sights on farming, whether it’s bass or bream farms in Greece, freshwater fish farms in Zambia, salmon farms in Chile, Barramundi fish farms in Saudi Arabia, land-based aquaculture in China or shrimp farms in Sri Lanka.[10] Wherever aquaculture-friendly policies and regulations are in place, private equity funds are swooping in, buying up and expanding production, and concentrating and consolidating the industry -- from feed production to fish farming to processing.

This is not to say that private equity is not interested in ocean fishing. There have been major private equity deals for trawling companies in recent years, such as KKR's investments in Chinese fishing giant Yuehai or Alantra's buyout of Spanish fishing company Unión Martín.[11]

Carsten Pedersen of the Transnational Institute says that the systems of privatised fishing rights that big conservation NGOs and seafood companies are promoting as a way to deal with overfishing can provide quick returns on investments and, as such, are attractive to private equity funds and other financial players.[12] Under these systems, governments put a total cap on how much of each species can be fished and then allocate permits for a share of the catch to fishermen and companies. Crucially, the permits can be sold or leased to others.

An investigation by ProPublica and the New Bedford Light into the "catch shares" system in the northeast of the US found that it greatly accelerated consolidation in the industry and encouraged the entry of private equity.[13]

Rights to fish “were free 30 years ago,” Seth Macinko, a former fisherman who’s now an associate professor of marine affairs at the University of Rhode Island, told the investigators. “But then came the conservation groups. Then there was consolidation. Then there was big money.”

Macinko says the system of private permits that began in 2010 “turned the privilege to catch a pound of fish into a commodity that could be bought or sold without owning a boat … It opened the door to private equity.” Skewed trade rules at the World Trade Organisation or in bilateral free trade partnership deals lock these in.

One of the financial players to invade the northeast US fishing industry has been Bregal Partners, a New York-based private equity firm owned by the Dutch Brenninkmeijer family, the heirs of global fashion retailer C&A. Through a company it co-founded in 2015, called Blue Harvest, it rapidly set out buying up fishing vessels, permits and processing facilities. The company was able to skirt lax antitrust rules and take a large share of the Northeast's important whitefish industry, leaving local fisherfolk with little choice but to work for Blue Harvest or lease their permits to the company. The company even charged fees to the fish workers working on its boats to boost its profits.[14]

“The price stays the same but all our expenses just keep going up,” said Joseph Drago, a fisherman who operates a scallop vessel for Blue Harvest. “Every trip they’re taking more and more out of the crew’s share.”

A harvest of cash and calamity

Private equity funds investing in fisheries and aquaculture claim to be promoting sustainable investments. This is likely part of their appeal to the many pension funds, foundations and public development banks that are participating in them (see Annex II).

Swedish-based private equity firm Altor, for instance, prides itself on its strong commitment to environmental, social and governance factors. Several pension funds, including PensionDanmark, the endowments of the University of Michigan and Princeton, and various foundations, including the Rockefeller Foundation, are invested in its Altor Fund III.[15] In 2014, Altor used this fund to acquire one of the largest salmon farming companies in Chile, Nova Austral. The transaction was done in partnership with US-based Bain Capital, through the two group’s jointly owned fish feed company Ewos.

Despite Altor's professed commitment to ESG, Ewos was implicated in a price fixing scandal in Chile that occurred during Alter's ownership of the company.[16] Nova Austral also set a record for environmental rule-breaking fines in the years following its acquisition by Altor. Chile’s Superintendency of the Environment described Nova Austral as a “serial offender” and the government filed a criminal suit against the company and its executives for repeated failures to comply with regulations.[17] In November 2022, Chile's State Defense Council filed another lawsuit against Nova Austral seeking compensation for "serious damage caused to the Alberto de Agostini national park, in Chile's Southern fjords, the Magallanes and the Chilean Antarctic regions".[18]

This is a time when coastal communities are under intense pressure to accept aquaculture, fishery reforms and other "development" projects to push a neoliberal "blue economy". Proponents talk about the investment that these projects will bring. But much of this investment runs through private equity funds. The overall behaviour of private equity groups in the fisheries and aquaculture sector looks much like what we found when investigating private equity's growing presence in food and agriculture in 2020: a ruthless commitment to extract profits for a few partners at the expense of local communities, the environment and the very people whose money is being used for these projects.[19]

The concentration of the global fishing industry into the hands of elite private equity groups does not offer communities any solution to their struggles for livelihoods, food sovereignty and justice. With all the issues dogging the industry – from labour exploitation to vast environmental pollution – there is no chance that private equity firms will bring about the right changes. Therefore it’s crucial to continue lifting the veil on who these actors are and to bring an end to their investments.

* For detailed references please contact Devlin Kuyek at [email protected]

[1]Sara Romero, "Entitats ecologistes s'oposen a l'ampliació de la piscifactoria de Calp per l'impacte ambiental," Directa, 29 March 2022: https://directa.cat/entitats-ecologistes-soposen-a-lampliacio-de-la-piscifactoria-de-calp-per-limpacte-ambiental/

[2]Maria Feijoo, "Avramar’s expansion of Spanish farm to go ahead despite opposition," Undercurrent News, 18 July 2022: https://www.undercurrentnews.com/2022/06/30/avramar-meets-with-objections-to-expanding-one-of-its-spanish-fish-farms/

[3]Neil Ramsden, “EU approves Andromeda’s deal for Nireus, Selonda,” October 2019: https://www.undercurrentnews.com/2019/10/30/eu-approves-andromedas-deal-for-nireus-selonda/

[4]Diorasis claims that it began investing in Greek fish farming in 2014 to take advantage of consolidation opportunities arising from the Greek debt crisis. See, Binyamin Ali, "PE investors look spoiled for choice at the aquaculture table," AgriInvestor, October 2020: https://www.agriinvestor.com/pe-investors-look-spoilt-for-choice-at-the-aquaculture-table/

[5]"Bill Gates investing in Greek aquaculture brand, Philosofish," Ambrosia Magazine, March 2020: https://ambrosiamagazine.com/bill-gates-investing-in-greek-aquaculture-brand-philosofish/

[6]Francesco De Augustinis, "Ocean desolation: how fish farm pollution is killing marine life in Greece," The Ferret, August 2021: https://theferret.scot/desolation-around-greek-fish-farms/

[7]Dan Gibson, "2021 seafood M&A passes $6.5bn after explosion of outside investment," Undercurrent News, 27 January 2022: https://www.undercurrentnews.com/2022/01/27/2021-seafood-ma-passes-6-5bn-after-explosion-of-outside-investment/

[8]For an introduction to what “private equity” is, and how private equity funds operate in the food and agriculture sphere, see GRAIN, “Barbarians at the barn”, September 2020, https://grain.org/e/6533.

[9]Carsten Pedersen and Yifang Tang, "Aquaculture, financialization, and impacts on small-scale fishing communities," Right to Food and Nutrition Watch, 2021: https://www.righttofoodandnutrition.org/files/rtfn_watch_art.02-2021_eng_web-2.pdf

[10]The National Aquaculture Group is the leading investor in fish farms in Saudi Arabia. It is owned by the Jeddah-based private equity fund MASIC. See, Ziad Sabbah, "Naqua: At the heart of Saudi Arabia's push to produce 600,000 tons of fish a year," Arab News, January 2022: https://www.arabnews.com/node/2012971/business-economy

[11]Lewis Hu, “KKR-backed China Yuehai Feed to invest $38m in ‘3R’ seafood plant,” Undercurrent News, 15 August 2022: https://www.undercurrentnews.com/2022/08/15/kkr-backed-china-yuehai-feed-to-invest-38m-in-3r-seafood-plant/

[12]Personal conversation, December 2022. For an overview of some of the key controversies dogging the fishing industry today, see GRAIN, “Of lobsters and mobsters: Who are the companies poaching the oceans?”, GRAIN, June 2021, https://grain.org/e/6692.

[13]Will Sennott, “How Foreign Private Equity Hooked New England’s Fishing Industry,” Civil Eats, 8 July 2022: https://civileats.com/2022/07/08/foreign-private-equity-hooked-new-england-fishing-seafood-fishermen-blue-harvest/

[14]Will Sennott, “How Foreign Private Equity Hooked New England’s Fishing Industry,” Civil Eats, 8 July 2022: https://civileats.com/2022/07/08/foreign-private-equity-hooked-new-england-fishing-seafood-fishermen-blue-harvest/

[15]Data on investors in Altro Fund III is from Preqin.

[16]Ewos was purchased by Cargill in 2015, and Cargill subsequently blew the whistle on the price fixing Ewos and other companies had been engaged in. See, Tom Seaman, "Cargill to win Chile market share with settlements over feed price-fixing," Undercurrent News, 13 February 2020: https://www.undercurrentnews.com/2020/02/13/cargill-to-win-chile-market-share-with-settlements-over-feed-price-fixing/

[17]Christian Molinari, “Chile’s environmental watchdog fines “serial offender” Nova Austral once again,” Seafood Source, 13 September 2021: https://www.seafoodsource.com/news/aquaculture/chiles-environmental-watchdog-fines-serial-offender-nova-austral-once-again

[18]María Feijóo, “Latest lawsuit against Chile’s Nova Austral could force closure of four farm sites", Undercurrent News, 21 November 2022: https://www.undercurrentnews.com/2022/11/21/latest-lawsuit-against-chiles-nova-austral-could-force-closure-of-four-farm-sites/

[19]GRAIN, "Barbarians at the barn", op cit.