Fishbone deforestation Rondônia, Brazil August 5, 2016. Credit: Planet Labs – Wikimedia Commons

When it comes to big polluters, few companies in the agribusiness sector can compete with the soybean farming giants of Brazil. Their environmental crimes include: land grabs, pesticide pollution and the deforestation of millions of hectares of biodiverse forests.1 Yet Brazil's soybean barons have never acted alone. From the time they started bulldozing the Amazon and the Cerrado in the 1980s, they have been heavily financed by foreign pension funds, banks and most of the other captains of global finance.

Brazil's soybean farming companies continue to depend on this foreign money to keep their chainsaws running, but getting access to it has become more difficult. Brazil's soybean sector is under increasing international scrutiny, and foreign financial companies have their reputations to worry about. So Brazilian soybean companies and their backers are looking for a solution – one that keeps the money and soybeans flowing, while washing their hands of the environmental and social destruction they generate. This is where the new world of green finance comes in, with its claim to support investments based on environmental, social and governance (ESG) factors.

In January this year, Amaggi, the company perhaps most associated with Brazil's soybean boom, launched a USD 750 million green bond on international markets to raise money for its purchase of certified soybeans and alternative energy projects.2 Amaggi is owned by Blairo Maggi, Brazil's notorious "King of Soy" and winner of the Golden Chainsaw Award. During his time as governor of the Brazilian state of Mato Grosso and as the federal Minister of Agriculture, Maggi oversaw and encouraged a huge expansion of soybean production into the biodiverse Cerrado. Maggi famously told the New York Times, “To me, a 40% increase in deforestation doesn’t mean anything at all, and I don’t feel the slightest guilt over what we are doing here.”3

AMAGGI. Photo: World Kings

What are green bonds?

Bonds are similar to loans. They are used by companies or governments to raise money for their operations. A company uses a bond to raise a set amount of money from financial investors. The bond will specify the amount of money to be raised; when the money has to be repaid, and the interest that the company has to pay to the bond holders. Normally companies will use bonds to raise money because they can repay the funds over a longer period and at a lower interest rate than a loan from the bank.

Green bonds are supposed to be issued to fund activities with environmental benefits, such as forest recovery and conservation, energy efficiency and renewable energy, sequestration and storage of greenhouse gas emissions, sustainable waste management, or conservation of water resources. When a company issues a green bond, they must hire a specialised company to certify that the activities funded by the bond meet the standards of the international green bond market and that the proceeds raised are used only for the stated activities. If a company fails to comply, the bond ceases to be a green bond and becomes just a traditional bond, which can generate an increase in interest rates in favour of the bond holder.

Green bonds are part of a larger category of bonds called, thematic bonds. While green bonds fund environmental projects; social bonds finance initiatives with social benefits in the areas of health, education, gender equity, housing, etc. Sustainability bonds, on the other hand, finance projects with mixed environmental and social benefits. And more recently, issuers that do not have a current project to back, but are committed to some future voluntary sustainable goal, can also issue transitional or sustainability-linked bonds (SLB), which do not require funds to be linked to a specific project, opening the door even further to greenwashing practices.

Big finance, big greenwash

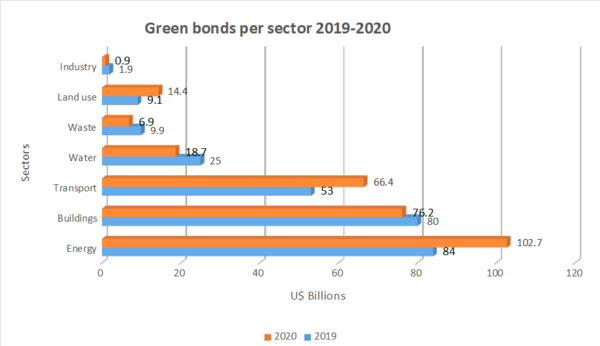

The soy companies in Brazil are not the only culprits.7 Across the world, the most notorious players in the expansion of industrial agriculture are turning to “green finance” to raise money. They include oil palm plantation companies, fish farming behemoths, pulp and paper manufacturers, meat and dairy giants, pesticide producers and commodity traders.(See Table 1). Agribusiness is one of the fastest growing sectors in the global market for so-called thematic financing instruments – green, social or sustainable. The total value of green bonds devoted to agriculture and land, for example, shot up by 59% between 2019-2020.8 (see graph 2)

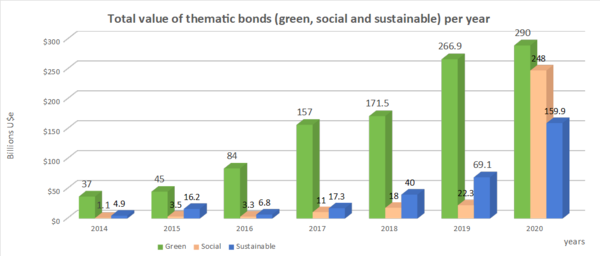

While the market for "green finance" is still relatively small – accounting for only USD 1.7 trillion out of a total global financial stock of USD 118 trillion – it is growing rapidly (see graph 1). The European Union's recent EUR 20 billion "social bond" was over-subscribed by 14 times, meaning it could have raised EUR 233 billion, which would have made it the largest debt sale in the history of the European bloc. In so-called emerging countries, the World Bank estimates that the market for green bonds will reach USD 100 billion within the next three years and USD 10 trillion by 2030.9 A big chunk of that is on track to go to agribusiness.

This soaring demand for "green finance" is largely coming from big institutional investors and especially pension funds.10 In part, they are legitimately worried about investing in dirty industries that are out of step with international and national commitments to reduce greenhouse gases or protect biodiversity. But their deeper interest in green finance is how it can be used to maintain their control over the money supply.

Altering public policies to maximise corporate profit

Big finance is concerned about the growing support for regulations on their investments, as well as for public control over the financing and implementation of the infrastructure and social services required to deal with today's multiple crises – be it climate change or Covid-19. Green finance provides a way for financial companies to show that they can be trusted to oversee and administer "green" and "socially responsible" investments, and that laws and regulations that penalise and limit their lending to dirty companies are not needed. It also helps ensure that they are not sidelined by public programmes. Green finance keeps them in control over the flow of money, so they can continue to extract billions of dollars in fees and other charges.

Syngenta CEO J. Erik Fyrwald with Sally Jewel (TNC Global Board Member and also COSTCO Wholesale Board Member) discussing collaborating for more sustainable agriculture at the Bloomberg Sustainable Business Summit. Photo: Syngenta

When it comes to the rapidly evolving "nature-based" side of green finance, governments are needed to commodify or privatise land and natural resources that corporations can use to sell carbon credits and "green" projects to access green finance. The allure of green finance has already enticed some governments overseeing major agribusiness expansion zones to implement land and environmental reforms that facilitate the transformation of land and "environmental services" into financial assets.12 This is the case in Colombia where a national programme called the “Investment Zones for Rural, Economic and Social Development” (ZIDREs) aims to allocate 7 million hectares of agricultural land to agribusiness companies.

The Brazilian government recently introduced legislation that simultaneously privatises large swaths of public land and allows agribusiness to issue bonds on financial markets using rural land as collateral. The bonds can be issued in foreign currencies and can be purchased by foreign companies or individuals. With the creation of investment funds specifically in agro-industrial chains (called Fiagro), foreign capital can buy those agribusiness bonds – that may have land and environmental services as ballast – and have an opportunity to evade restrictions on foreign ownership of Brazilian farmland.13 A similar system was implemented in Argentina during its debt crisis in the 2000s with profound consequences. Today, 208 investment funds hold 235 thousand hectares of Argentine farmland via the issuance of USD 800 million in agribusiness bonds.14

In addition to de-risking, much of the actual "finance" in green finance also relies directly on the public sector, not the private. So far, the vast majority of green bonds have been issued by public banks and government-backed entities like the Société du Grand Paris which is responsible for Paris' public transportation network, and development banks like the World Bank or Germany's KfW. 15 Governments themselves have been increasingly issuing green bonds. The value of these sovereign green bonds increased by 37% in 2020, with most funds going to finance transportation infrastructure. In October 2020, the European Commission announced it would issue EUR 225 billion of its EUR 750 billion (USD 265.87 billion and USD 886.23 billion respectively) recovery debt in the form of green bonds – more than the total value of all green bonds issued in the world in 2019. 16 There has also been an exponential increase in so-called “social” bonds issued by multilateral banks and developing country governments to finance Covid-19 measures (known as pandemic bonds).17 Sovereign sustainability bonds, which have both "green" and "social" aspects, were up by more than 1000% in 2020.

Debt-for-Nature Swaps

Within its new green economic recovery setup, the European Union is contemplating raising taxes on imports that have a high environmental impact. This entails imposing non-tariff barriers to commodities that have not “neutralised emissions" in their countries of origin. This would accelerate the demand for agroindustrial “fixes” by major agricultural commodity producing countries to access green finance and markets.

On the other hand, emerging market countries, in the midst of a severe economic crisis and a dramatic increase in their indebtedness, do not have money to finance this green push in their economies or to pay extra pollution taxes. Green sovereign debt bonds linked to biodiversity and carbon emissions targets are gaining prominence in the debt negotiations of these countries. The World Bank and the IMF intend to bring a concrete proposal to the United Nations Food Systems Summit (23 September, 2021) for the issuance of green sovereign bonds in order to leverage resources at a time of strong investor demand for environmental assets. Argentina, Brazil, Chile, Paraguay and Uruguay, also intend to take a common stance at the upcoming UNFSS through the Southern Agricultural Council (CAS) on the environmental services provided by agricultural and agroforestry systems in Latin America and the Caribbean which hold half of the world’s forests and biodiversity.

To do so, the countries are working to set a definition for the value and rules for establishing markets for carbon credits and also for other ecosystems services such as water regulation and biodiversity maintenance. 18

The Debt-for-Nature swaps consist in lowering the debt service cost of countries that meet the sustainable goals of the 2030 agenda, either by paying less interest or with carbon or biodiversity credits. According to the Climate Bonds Initiative, the issuance of themed sovereign bonds by the end of 2020 soared to USD 97.7 billion, with 22 issuing countries.

Even the purchasing of green bonds could arguably be described as public. The biggest buyers of green bonds are, alongside development banks, institutional investors such as pension funds and asset managers like BlackRock. Most of the funds they manage are workers’ retirement savings – now worth over USD 50 trillion dollars. This is fundamentally people's money, from which financial companies are making fortunes by extracting fees.

In 2018, the World Bank's International Finance Corporation (IFC) and Europe's largest investment fund manager, Amundi, launched a USD 2 billion fund to invest in emerging markets’ green bonds. So far, the buyers have almost entirely been development banks like the IFC, France's Proparco, the European Investment Bank and the European Bank for Reconstruction and Development, as well as public pension funds, such as the French public service supplementary pension scheme (ERAFP) and Swedish pension funds Alecta, AP3 and AP4.19

To a lesser extent, corporations are starting to issue their own thematic bonds, but with more flexible environmental, social and governance criteria. Some of the big corporate green bonds from the past two years include those from the pharmaceutical giants Pfizer (USD 1.3 billion) and Novartis (USD 5.8 billion), one from Alphabet (the holding company for Google), and a USD 1 billion bond from Amazon to fund generic projects that "advance people and the planet".20 In 2021, the Kellogg Company became the first processed food corporation to issue a sustainability bond (USD 363 million) to "address the interconnected issues of wellbeing, hunger relief and climate resiliency, including projects where the raw material for your business comes from, land use and natural resources, as water management."21

The key question is what actually constitutes a "green" investment? A dirty company like Amaggi or Shell can raise green funding for some segments of its operations where it may be putting in place alternative energies, while continuing to engage in overall business practices that contribute massively to the climate crisis and other environmental disasters. Furthermore, the gatekeepers of this flimsy system are not neutral parties, but are largely private companies in Europe, like Sustainalytics, who depend on green bonds to stay afloat.22

Art by Boy Dominguez

Sustainability-linked bond sales grew from USD 5 billion in 2019 to USD 19 billion in April 2021, attracting big polluters like the Italian energy company Enel, which issued a USD 4 billion SLB, and pension fund managers like APG of the Netherlands, one of the big buyers of Enel's SLB.23 APG admits that the flexibility of SLBs make them susceptible to greenwashing, but this didn't stop it from spending USD 886.23 million on a SLB issued by the British supermarket chain Tesco as part of its pledge to cut its greenhouse gas emissions by 60% by 2025.24

The European Central Bank has also included SLBs in its asset purchase programme.25 This is important because, given the sheer size of its green bond offerings, the EU will likely become the standard setter for the "taxonomy" of green finance (i.e. what is and what is not considered "green"). Beyond its problematic endorsement of SLBs, the EU is also moving to include natural gas and other dirty energy activities within the scope of its green finance programme due to heavy lobbying by corporations and several member states. Meanwhile, as noted by economist Daniela Gabor, "European commitments to develop in parallel a system that works towards penalising dirty lending have evaporated."26

Even with all this greenwashing, corporations are not carrying out enough "green" activities to absorb the money that big finance has on the table. So the "green" has to be invented, and agribusiness is well-positioned to provide the land and natural resources that can serve as collateral.

Agribusiness to the rescue

The food system accounts for over a third of all global greenhouse gas emissions, and agriculture takes up the largest share of emissions within this sector. Agriculture is also a leading cause of deforestation and land degradation – both of which have major implications for the climate. This means that agriculture is critical to reducing emissions and could help take CO2 out of the atmosphere by restoring it to the soil. For agribusiness, therefore, there is a huge opportunity to access green finance for operations they claim will reduce their emissions, and to get paid through carbon credits for avoiding deforestation or regenerating soils on their farms or among their suppliers.

Samunnati. Photo: Inc42 media

Nature-based solutions have been widely criticised for distracting from and postponing the real emissions cuts that must be made, and for depending on a massive grab of indigenous peoples’ and peasants’ lands and forests.29 Despite this, the corporate interest in nature-based solutions, regenerative agriculture and other forms of carbon credits and offsets from agriculture continues to grow. Swiss food giant Nestlé has made "regenerative agriculture" projects a central part of its net-zero plan, with expectations that it will allow the company to offset 13 million tonnes of its greenhouse gas emissions per year by 2030, an amount roughly the size of the total annual greenhouse gas emissions for a small country like Latvia.30 In August 2021, the Japanese conglomerate Mitsubishi bought a 40% stake in Australian Integrated Carbon, which works with Australian farmers to adopt farming practices that sequester carbon in soils to then sell carbon credits to polluting companies like Mitsubishi who want to offset their fossil fuel emissions.31 Similarly, the seed and chemical giant Bayer is pursuing a carbon credit business in Brazil and Argentina through a project called PRO Carbono.32

For agribusiness companies, if they can develop financial instruments – such as green bonds, that enable them to tap into it, the potential pot of money is huge. The UK-based Climate Bonds Initiative claims that Brazil's agribusiness sector alone could raise upwards of USD 135 billion by 2030 through green bonds linked to sustainable agricultural practices.33 Climate Bonds Initiative certified its first Brazilian agribusiness green bond in 2020 to a company called Rizoma Agro that focuses on converting large-scale grain farms in the Cerrado to "regenerative" practices that rebuild carbon in soils.34

Bunge and Syngenta also received green bank loans for projects in the biodiverse Cerrado area, in this case to expand soybean plantations over pasture areas instead of forested areas35. These “regenerative agriculture” projects will produce certified "deforestation-free" soybeans, even though the conversion of pasture lands to soybeans in the Cerrado is known to displace cattle production into the Amazon rainforest and to cause numerous other environmental damages36. Meanwhile, in 2019, Marfrig, a major Brazilian beef producer and one of the worst climate polluters in the agribusiness sector that was exposed last year for purchasing cattle from illegally deforested areas of the Amazon, issued a USD 500 million SLB to finance the implementation of a "deforestation-free" tracking system for cattle it purchases from the Amazon biome!37

Even the financial companies that bought up huge swaths of farmland in Brazil and other parts of the world over the past decade are now investigating ways to generate carbon credits from their operations and to attract investment from pension funds and other institutional investors by marketing farmland as a green investment play.38 Canada's Caisse de Dépot et Placement pension fund, one of the world's most important buyers of green debt and a major investor in farmland in Brazil's Cerrado, issued its own USD 1 billion green bond in May 2021. It intends to use part of the proceeds to buy more farmland.39

Digital agriculture companies also stand to win big from green finance. The early batch of green finance instruments indicates that many of the proceeds will be used to fund the adoption of digital technologies in agriculture under the assumption that these can create efficiency and reduce greenhouse gas emissions. Moreover, carbon credit and green bond-funded projects require the adoption of digital technologies for monitoring and certification. This is the case with a project in the Southern Cone of Latin America that Cargill, the world's largest agribusiness company, is financing through a USD 30 million investment in a Land Innovation Fund.40 The project measures, tracks and provides a continuous digital record of the soil emissions produced by soybean farmers supplying Cargill.

All of this clearly adds up to more corporate and financial control; it is a lot harder to see how it will make things greener.

Turning off the money supply for corporate agriculture

Investment in the expansion of agribusiness can never be "green". Nor does it seem possible for big finance to invest in anything other than agribusiness when it comes to agriculture. Both depend on the financialisation of nature and the relentless dispossession of people's control over their lands, forests, waters and biodiversity. Under global finance's new green architecture, the formula remains the same: capture public goods and spending to maximise profits for a select group of investors, while providing large polluting corporations with access to a new source of "green" money to maintain business as usual. The only difference this time is that "nature" is being used directly for the issuance of debt.

Whether it is called "green" or "socially responsible", nothing good can come out of the marriage of big finance and corporate agribusiness. Food sovereignty – the only viable solution for climate justice – will not be financed by Wall Street or the City of London, nor will it be constructed by Cargill and Bayer. It can only be built when people take back control over their lands, seeds, knowledge, and the money supply too.

GRAIN, 2021 from Climate Bonds Initiative data https://www.climatebonds.net/market/data/#use-of-proceeds-charts

GRAIN, 2021 from Climate Bonds Initiative data https://www.climatebonds.net/market/data/#use-of-proceeds-charts

** Correction: title should be "Increase of green bonds emitted per sector 2019 -2020". GRAIN, 2021 from Climate Bonds Initiative data https://www.climatebonds.net/market/data/#use-of-proceeds-charts

Green finance ventures by agribusiness

Company | Green finance mechanism | Notes |

Green bond worth USD 94 million issued in 2020. It was raised in green agribusiness bonds (Agribusiness Receivables Certificates) to be applied in digital and low Carbon Farming Practices, Integrated Systems (Crop-Livestock) in its 460 thousand hectares of soy, maize and cotton monoculture plantations. The green bond was issued through Bradesco bbi, Itaú and Santander banks. | The second party opinion (SPO), Resultante, listed in its report several passages linking SLC Agricola with environmental crimes and land grabbing. Although it was approved, the issuance of the green bond was validated with the recommendation of not allocating the funds to those questionable areas. | |

Sustainability bond worth USD 750 million in 2021 to be applied to its 170 thousand hectares in a mix of environment projects such as renewable energy and land use, as well as in socio-economic activities as job creation. The bond was coordinated by BNP Paribas, Bradesco Securities, Inc., Citigroup Global Markets, Inc., Itaú BBA USA Securities, Inc., JP Morgan Chase & Co., Rabobank and Santander Investment. | Amaggi group is the largest exporter of soybean from Brazil and is a major buyer of soybean from known deforesters like SLC Agrícola and BrasilAgro, and has not yet agreedto a 2020 cut-off date for land clearing in the Cerrado region. | |

Green bond of EUR 75 million (USD 89 million). to be issued in Europe in 2021. Proceeds will be used for various activities including reducing greenhouse gas emissions and expanding its farming operations. | AgriNurture Inc. is a company based in the Philippines that received early backing from Cargill's hedge fund Black River and the Far Eastern Agricultural Investment Company of Saudi Arabia. It has become one of the largest farming companies and agricultural exporters in the country through the development of large-scale farms and plantations, most recently for maize in Mindanao. | |

Olam has secured three "green" loan facilities since 2018 from different consortiums of banks: a sustainability-linked loan of USD 500 million in 2018, a USD 525 million sustainability-linked revolving credit facility in 2019 and a USD 525 million sustainability loan in 2020-- all to be used for general spending but with an interest margin dependent on Olam's ability to meet various targets. In 2019 it launched the world’s first "digital loan" of USD 350 million. | Olam is an Indian non-resident company based in Singapore. It is one of the world's largest commodity traders and has invested heavily in farming operations and contract farming schemes, particularly in Africa and Latin America. It is part-owned by Singapore’s sovereign wealth fund Temasek and Japan’s Mitsubishi. It claims to have 2.4 million hectares under direct management, including a controversial 144,000 hectare oil palm plantation concession in Gabon. | |

Sustainability-linked loan with 20 banks, worth USD 2.3 billion in 2019. ING, BBVA and Rabobank acted as sustainability coordinators. ABN AMRO has acted as coordinator and facility agent. | It was the largest loan by an agricultural trader. The loan is linked to a general year-on-year improvement target of ESG performance, assessed by SPO Sustainalytics and increasing its traceability of Brazilian agri-commodities. In late 2020, the World Bank's International Financing Corporation (IFC) began subsidising the traceability of the direct suppliers of soybean in Matopiba, in the Cerrado region (Brazil). | |

In July 2021, Samunnati issued a USD 4.6 million agricultural green bond via the market platform Symbiotics. The proceeds are to be "fully allocated towards climate smart agriculture." | Samunnati is an Indian micro-credit lender for farmers and agribusiness. Its investors include the US pension fund TIAA and the US government's International Development Finance Corporation. | |

A ten-year loan of USD 50 million to soybean suppliers in Cerrado to support a deforestation-free target. This is Santander Bank and The Nature Conservancy (“TNC”) financial mechanism that is not formally considered as green finance, but that links the expansion of soy to a “compliance with environmental law” in Brazil. | The Responsible Commodities Facility (RCF) and the Soft Commodities Forum Platform, bring together giant agribusiness traders (ABCD, Cofco, Viterra -ex Glencore Agriculture) to issue new "green" agribusiness debt instruments for the expansion of soybean plantations over pasture areas. | |

Cargill | Land Innovation Fund, created with Cargill's USD 30 million to support the expansion of soybean over degraded pasture areas in Argentina and Paraguay’s Cerrado and Gran Chaco. The fund is incorporating the suppliers into a traceability chain for measuring soil carbon emissions. The Bank of Cargill is increasing its use of agribusiness bonds to fund soybean suppliers, with a rise of 30% in 2020 in Agribusiness Letters of Credit. The company is part of the Brazilian Initiative for Green Finance to support the emission of green bonds in agriculture. | Cargill is perhaps the soybean trader most linked to deforestation and fires in their supply chain. In 2019, Nestlé stopped sourcing all of its purchases of Brazilian soy from Cargill with the trader not being able to trace soybeans from its suppliers. In 2020, Norwegian Grieg Seafood did not allow any funds from its Green Bond worth USD 103 million to be used to purchase feed supply from Cargill until the company had significantly reduced itsrisk of soybean-related deforestation in Brazil. |

Onesustainable transition bond worth USD 500 million issued in 2019 through BNP Paribas, ING and Santander, to purchase deforestation-free cattle from direct suppliers in Amazonia. Onesustainability-linked loan worth USD 30 million in 2021 as part of green financing to support Mafrig’s transition to a no-deforestation requirement across its entire chain. | The first labelled “transition bond” issued in the world, after the green bonds held by one of the world’s biggest beef producers were refused by investors. The bond was re-labelled to support high-emitting companies that do not fit green bonds requirements to clean up their supply chain. Only two other transition bonds of this kind were issued in 2020 due to the lack of reliability. | |

Green bond worth USD 5 million issued as a green agribusiness bond (Agribusiness Receivables Certificates) to support the expansion of regenerative and organic agriculture production in its 1200 hectares located in São Paulo, Brazil. It was structured by the financial consultancy Ecoagro. | The first certified agriculture green bond issued in the world, according to the new CBI principles for the agriculture sector. According to Rizoma's founding partner, Pedro Paulo Diniz, regenerative agriculture has the potential to offset "more than 100% of human carbon emissions" and often "has more biodiversity than a native forest". | |

Ventisqueros | Chilean salmon farmer Ventisqueros announced at the end of 2020 that it had landed a USD 120 million green loan from banks Rabobank and DNB. The proceeds will fund the expansion of production from the current 40,000 metric tonnes to 60,000 metric tonnes. | In 2019, there was a massive escape of salmon from one of Ventisqueros' farms in Chiloé leading to a complaint from the National Fisheries and Aquaculture Service (Sernapesca) before the Superintendency of the Environment and in court. The company has also refused to comply with a sentence issued by the Council for Transparency ordering them to provide Oceana with data on their use of antibiotics in 2015, 2016 and 2017. |

Mowi | Mowi completed a USD 165 million green bond in 2020, the first green bond issued by a seafood company. The proceeds will be used for green projects as defined by Mowi’s green bond framework. | Norway-based Mowi is the world's largest aquaculture company and largest salmon producer. It is notorious for the aggressive tactics it deploys against critics and for the damage it has caused to the environment, particularly to wild salmon stocks. |

Long-term loan for the recovery of degraded pasture areas by soybean planting via the Reverte programme, led by Syngenta in partnership with TNC and Itaú bank. Although not formally a “green loan”, the Itaú bank already reserved USD 86 million to “restore” 30 thousands hectares in Cerrado with soybean and other inputs provided by Syngenta. | The Reverte programme announced by Syngenta aims to “restore” 1 million hectares by 2025. In addition to using green finance to sell inputs and the obligation to use the traceability system, the Syngenta Group traded the seeds in exchange for the soybean harvest (barter operation) and operated the export of the company's first cargo ship of soybeans from Brazil to China. | |

Three Green bonds totalling USD 639 million in 2020 and 2021 coordinated by Morgan Stanley to produce ethanol from maize and produce 100% renewable energy. One sustainability-linked bond worth USD 26 million with Credit Suisse Bank and one sustainability-linked loan of USD 33 million in 2020 with Santander bank, conditioned to: reducing the carbon footprint; improving the traceability of suppliers, and disclosure and transparency in its annual reports. | This was the first green agribusiness bond for the bioenergy sector, called Agribusiness Receivable Certificates (CRA). The company produced 100% of ethanol for maize. The bioenergy sector, along with the forestry sector, is one of the biggest issuers of green and sustainability bonds. | |

Suzano S.A. | Four Green bonds since 2016 totalling USD 1.6 billion for pulp and paper industrial forestry. The offering was coordinated by J.P. Morgan, Goldman Sachs, Morgan Stanley, Bank of America, BNP, Crédit Agricole, MUFG, Santander, Rabobank, SMBC Nikko, Scotiabank and Mizuho. Two sustainability-linked bonds (SLB) totalling USD 1.2 billion in 2020 and another USD1 billion SLB issued in June 2021, through BNP Paribas, BofA, J.P. Morgan, Mizuho, Rabo Securities and Scotiabank. Onesustainability-linked loan worth USD 1.6 billion in January 2021 operated by BNP Paribas. Both SL bonds and loans are linked to reducing the company's direct emissions and water consumption across all its operations and purchases (scopes 1 and 2) and also have an “inclusion” target to have woman in leadership positions. | Suzano was the first issuer of green bonds and sustainability-linked bonds in Brazil and has 37% of its debts tied to green finance. Suzano S.A has more than 1 million hectares of industrial pine and eucalyptus monoculture plantations in Brazil and is historically linked to a series of human rights violations against local communities and the labour rights of its workers. |

Sustainability bond worth USD 95 million issued in 2018 by the USAID initiative Tropical Landscapes Finance Facility (TLFF) through BNP Paribas in partnership with WWF. The bond was issued to fund 88 thousand hectares of rubber plantation for PT Royal Lestari Utama (RLU), an Indonesian joint venture between France’s Michelin and Indonesia’s Barito Pacific Group. | Asia's first sustainability debt instrumentand part of the Memorandum of Understanding between UN Environment and BNP Paribas that was signed at the One Planet Summit in Paris in December 2017. The target is to reach USD 10 billion of innovative sustainable finance by 2025 for projects that support sustainable agriculture and forestry in ways that help solve the climate crisis. |

1 Claire Acher, “Brazil soy trade linked to widespread deforestation, carbon emissions”, Mongabay, 3 April, 2019. https://news.mongabay.com/2019/04/brazil-soy-trade-linked-to-widespread-deforestation-carbon-emissions/

2 Ana Mano, “UPDATE 1-Brazil's Amaggi soybean producer prices $750m green bond –CFO”, Reuters, January, 2021.

3 Jenny Gonzales, “Soy King Blairo Maggi wields power over Amazon’s fate, say critics”, Mongabay, 13 July 2017. https://news.mongabay.com/2017/07/soy-king-blairo-maggi-wields-power-over-amazons-fate-say-critics/

4 Caio de Freitas Paes, "Trader Cargill, pension fund TIAA linked to land grabs in Brazil’s Cerrado", 3 February 2021. https://news.mongabay.com/2021/02/trader-cargill-pension-fund-tiaa-linked-to-land-grabs-in-brazils-cerrado/; Global Witness, "Razing the stakes", 6 May 2020. https://www.globalwitness.org/en/campaigns/forests/razing-stakes/

6 Resultante, “Second Opnion. Relatório Final”, CRA verde. 24 November 2020. Accessed August 2021.https://isecbrasilsiteblob.blob.core.windows.net/ri-files/EMISS%C3%95ES/ISEC/CRA/EMISSAO%2020%20SERIE%2001/RESULTANTE_SLC_Relat%C3%B3rio%20Final_CRA%20Verde_24112020_v.2.pdf. See also: https://www.slcagricola.com.br/ra2020/en/pdf/slc_ra_2020_1.pdf

7 To see the Brazilian private companies that have issued thematic bonds access the database of Sitawi specialized consultancy (SPO) seehttps://www.sitawi.net/noticias/sitawi-lanca-primeiro-banco-de-dados-de-titulos-verdes-no-brasil/. See also Climate Bonds Initiative: “Agriculture sustainable finance state of the market: Brazil briefing paper 2021”.https://www.climatebonds.net/files/reports/cbi-brazil-agri-sotm-eng.pdf

8 Climate Bonds Initiative (CBI), “Sustainable Debt. Global state of the market 2020”, p.9. https://www.climatebonds.net/files/reports/cbi_sd_sotm_2020_04d.pdf . The updated green bond market data is mostly based in CBI data, the only global certifier of green bonds.

10 To see all investors that have signed public statements and participated in the green bond market see:https://www.climatebonds.net/get-involved/investor-statement

11 Daniela Gabor, “Private finance won’t decarbonise our economies – but the ‘big green state’ can”, The Guardian, 4 June 2021. https://www.theguardian.com/commentisfree/2021/jun/04/private-finance-decarbonise-economies-green-state

12 GRAIN, "Digital Fences: Financial enclosure of agricultural land in South America", 22 September 2020.https://grain.org/e/6531

13 The new private finance vehicle,Fiagros, is based on the Brazilian Securities Commission's Resolution No. 39/2. Besides changes to the land law (Law 13.465/17), the rural credit instruments (Law 13.986/2020), and the agribusiness bonds (Law 14.130/2021), the legislature also approved a payments for environmental services law (14.119/2021) that includes carbon credits, environmental reserve quotas and green bonds.

14 GRAIN, “Digital Fences”, 2020. See the complete cases in the Annex available in Portuguese and Spanish:https://grain.org/system/attachments/sources/000/006/141/original/PT_zonas_de_expans-o_e_investimento_na_Am-rica_do_Sul_PDF_18_09.pdf

15 See Climate Bonds Initiative (CBI). 2020. Op cit. p. 7. Development Banks have issued 68% of the total sustainability bonds, worth USD 108 billion. The World Bank, through the International Bank for Reconstruction and Development, has been the largest issuer of these bonds totalling USD 81 billion in 2020, tripling its investments compared to 2019. It also provides technical assistance to other issuers, particularly in the process of issuing green, social, or sustainability (GSS) sovereign bonds by developing countries, in CBI. 2020. Op.cit. p.12

16 Mehreen Khan. “Is Brussels green bond washing?”, Financial Times, 19 October 2020. https://www.ft.com/content/38130bf9-2bcc-494e-9b71-889d517edc7a

17 China tops the list of the largest issuers of these social bonds, raising USD 68 billion, mainly in pandemic bond. CBI.2020. op.cit. p.14.

https://dialogochino.net/es/clima-y-energia-es/43781-argentina-apuesta-a-un-canje-verde-de-su-deuda-soberana/

19 “Green bond fund of the year, Initiative of the year: Amundi and IFC's Emerging Green One”, Green Finance, 2 April 2019: https://www.environmental-finance.com/content/awards/green-social-and-sustainability-bond-awards-2019/winners/green-bond-fund-of-the-year-initiative-of-the-year-amundi-and-ifcs-emerging-green-one.html; Rachel Fixsen, "Alecta, ERAFP among backers of $1.4bn EM green bond fund," IPE Magazine: 19 March 2018: https://www.ipe.com/alecta-erafp-among-backers-of-14bn-em-green-bond-fund/10023735.article; "Amundi's one-year-old green bond fund 'ahead of schedule'," Environmental Finance, 4 March 2019: https://www.environmental-finance.com/content/analysis/amundis-one-year-old-green-bond-fund-ahead-of-schedule.html

20 Climate Bonds Initiative (CBI), 2020. op.cit. p. 11. Other corporations issuing green bonds in 2020 include Volkswagen (USD 2.3 billion) Daimler AG (USD 1.1 billion) and Volvo (USD 588 million). p.6. See also Environmental Finance. Sustainable Bonds insight 2021. https://www.environmental-finance.com/assets/files/research/sustainable-bonds-insight-2021.pdf

21 Mich Battle Creek,“Kellogg Company Announces Pricing of its Inaugural Sustainability Bond”, Kellogg’s, May 11 2021. https://newsroom.kelloggcompany.com/2021-05-11-Kellogg-Company-Announces-Pricing-of-its-Inaugural-Sustainability-Bond

22 These external specialised agents, as Second Part Opinion (SPOs) or certification agencies, follow parameters also created by private specialised agencies and adopted by the international green bond market as the International Capital Market Association (ICMA) – responsible for elaborating the Principles of Green Bonds, Social Bonds, and the Guidelines for Sustainable Bonds; the World Bank; the International Finance Corporation (IFC); and the Climate Bonds Initiative (CBI).

23 Xuan Sheng Ou Young. “Why investor appetite for sustainability-linked bonds is growing”, BNP Paribas Asset Management Blog, 22 July 2021.https://investors-corner.bnpparibas-am.com/investing/why-investor-appetite-for-sustainability-linked-bonds-is-growing/

24 APG. “Sustainability bonds: new opportunities, but avoid greenwashing”, 9 July 2021. https://apg.nl/en/publication/sustainability-linked-bonds-new-opportunities-but-avoid-greenwashing/

25 Stephen M. Liberatore, “Sustainability-linked bonds do not fit our impact framework”, Nuveen, A TIAA company 2021. https://www.nuveen.com/global/insights/income-generation/sustainability-linked-bonds-do-not-fit-our-impact-framework

26 Daniela Gabor, "Private finance won’t decarbonise our economies – but the ‘big green state’ can", The Guardian, 4 June2021: https://www.theguardian.com/commentisfree/2021/jun/04/private-finance-decarbonise-economies-green-state

27 For more on FOLU and the agribusiness greenwashing lobby promoting "nature-based solutions" see, GRAIN, "Corporate greenwashing: "net zero" and "nature-based solutions" are a deadly fraud", 17 March 2021: https://grain.org/en/article/6634-corporate-greenwashing-net-zero-and-nature-based-solutions-are-a-deadly-fraud

28 The FAO/TNC reports are here: http://www.fao.org/land-water/overview/integrated-landscape-management/nature-based-solutions/en/. There is no international definition or criteria on “regenerative agriculture” but the examples in the reports highlight a mix of traditional and industrial practices such as no-till farming, crop rotation, precision agriculture technologies and gene editing for the production of biofertilisers and microorganisms. For FOLU's perspective on the concept, see: “Growing Better. Ten Critical Transitions to Transform Food and Land Use”, 2019, especially “Critical Transition 2. Scaling productive and regenerative agriculture”, https://www.foodandlandusecoalition.org/wp-content/uploads/2019/09/FOLU-GrowingBetter-GlobalReport-ExecutiveSummary.pdf. For the World Economic Forum’s view see: “The Future of Nature and business”, 2020. http://www3.weforum.org/docs/WEF_The_Future_Of_Nature_And_Business_2020.pdf

29 See for example, Corporate Accountability, Global Forest Coalition, Friends of the Earth International, "The Big Con: How Big Polluters are advancing a “net zero” climate agenda to delay, deceive, and deny", June 2021: https://www.corporateaccountability.org/resources/the-big-con-net-zero/

30 GRAIN, "Corporate greenwashing: "net zero" and "nature-based solutions" are a deadly fraud", 17 March 2021: https://grain.org/en/article/6634-corporate-greenwashing-net-zero-and-nature-based-solutions-are-a-deadly-fraud

31 Andrew Marshall, "Mitsubishi and AIC team up for carbon farming credits", The Land, 4 August 2021: https://www.theland.com.au/story/7370631/mitsubishi-buys-into-carbon-farming-with-aic-partnership/?src=rss

32 “Bayer lança programa no Brasil para captura de carbono na agricultura”, Reuters, 27 May 2021. https://www.reuters.com/article/commods-bayer-carbono-idBRKCN2D82T8-OBRBS and “Bayer anuncia el lanzamiento de la primera fase de la iniciativa Carbono en la Argentina”, Bayer, 22 July 2021. https://www.conosur.bayer.com/es/bayer-lanza-la-iniciativa-de-carbono-en-argentina

33 “Título verde pode injetar R$ 700 bilhões na agricultura brasileira até 2030”, Nova Cana, 7 January 2021. https://www.novacana.com/n/industria/financeiro/titulo-verde-injetar-r-700-bilhoes-agricultura-brasileira-2030-070120

34 “Ecoagro and Rizoma Agro announce the world's first Green Bond Certified under the Climate Bonds Standard for Agriculture”, CBI, 2 September 2020. https://www.climatebonds.net/resources/press-releases/2020/09/ecoagro-and-rizoma-agro-announce-worlds-first-green-bond-certified

35 About Green finance and green bonds by agribusiness in Brazil see: Grupo Carta de Belém. “Mapeamento das distintas iniciativas sobre recuperação econômica e retomada verde”. December 2021. Especially Gabriela de Oliveira Junqueira. Relatório Final. Eixo 1 e Junior Aleixo. Relatório Final, Eixo 2. An executive report will be published by the end of 2021.

36 From 2000 to 2014, more than 80% of soybean expansion in the Cerrado took place over areas of pasture and other crops, driving the advance of cattle ranching into the Amazon forest, particularly in northern Mato Grosso and southern Pará states in Diana Aguiar and Maurício Torres. “Deforestation as an instrument of land grabbing: enclosures along the expansion of the agricultural frontier in Brazil”, Agro é Fogo,

37 Jasper Cox, "Brazil bonds make green investors look ridiculous," Global Capital, 27 August 2019: https://www.globalcapital.com/article/28mtxz67sok79sit5mosg/tuesday-view/brazil-bonds-make-green-investors-look-ridiculous; "Brazil beef giants linked to illegal Amazon deforestation", Mongabay, 11 December 2020: https://news.mongabay.com/2020/12/brazil-beef-giants-linked-to-illegal-amazon-deforestation/; and for information on Marfrig's GHG emissions see GRAIN and IATP, "Emissions impossible: How big meat and dairy are heating up the planet", July 2018: https://grain.org/e/5976

38 GRAIN, "The global farmland grab goes green", 10 May 2021: https://grain.org/e/6667

39 Elisabeth Jeffies, “Hard reality: Why Canada’s pensions are blazing a trail in green bond issuance”, Capital Monitor, 15 July 2021. https://capitalmonitor.ai/institution/asset-owners/canadas-pensions-are-world-leaders-in-green-bond-issuance/ ; https://www.cdpq.com/sites/default/files/medias/pdf/en/CDPQ_GreenBond_Framework_SPO2021.pdf

40 Land Innovation Fund. https://www.landinnovation.fund/.