Activists from the Fossil Free Agriculture campaign protest in front of the European Mineral Fertilizer Summit.

Photo: Free the Soil

Corporations are ramping up their greenwashing to head-off any efforts to reign in their GHG emissions. After five years of having done nothing to move towards the already compromised targets established by the 2015 Paris Agreement, dozens of big polluters like Nestlé and Shell are now making "net zero" pledges, mainly to satisfy the public relations needs of the financial players that fund them. The shift in corporate greenwashing will do nothing to reduce emissions but risks generating a massive land grab for forests and farmlands, particularly in the global South. Food and agribusiness corporations are leading actors in this deadly scam. Climate action will go on being undermined by corporate greenwashing until people take back control over the funds, territories and governments that are captured by corporations.

Corporations are, without a doubt, the number one obstacle to meaningful action on the climate crisis. These almighty actors have spent the past two decades undermining scientific consensus, blocking meaningful legislation and greenwashing their own responsibility. Even the last ditch Paris Agreement, with its lame voluntary commitment to keep the world to a still disastrous 1.5 degrees of warming, has done nothing to stop corporate greed from taking the planet to the brink.

Since the signing of the Paris Agreement in 2015 and its promise of market-based solutions, few corporations have even done the bare minimum to disclose their emissions, let alone to take actions to reduce them. Out of the world's top 500 corporations, just 67 have made commitments to reduce their emissions in line with the Paris Agreement.

1 The vast majority of corporations are still not disclosing their emissions, let alone taking any actions to address them.

2 Moreover, while not a single global financial corporation has yet adopted policies to curb the burning of fossil fuels, the money they channel to fossil fuel companies has increased every year since the Paris Agreement was adopted, totalling over $2.7 trillion in the past five years.

3

Food and agriculture companies are among the worst performers. Attention to their role in the climate crisis is increasing, with the latest IPCC report estimating that the food system accounts for up to 37% of total global GHG emissions.

4 Yet, of the top 35 global meat and dairy companies, the worst climate offenders within the sector, just one of them has committed to reduce its absolute emissions in line with the Paris targets. This has not prevented these companies from receiving billions of dollars from global financial corporations, including those that claim to be committed to responsible investing.

5

Climate demonstration in London. Photo: Red Pepper

It was easier for corporations to get away with doing nothing when the climate crisis was not so physically evident as it is today. They also now have to grapple with a growing, youthful climate movement that carries influence over governments and that directly targets corporations, including the bloated financial companies that continue to funnel people's retirement savings into the worst polluters. And then there's the covid-19 pandemic, which has blown a hole in the neoliberal consensus and made plain the importance of government intervention to deal with global emergencies. Not to mention that a climate denier no longer occupies the White House. For corporations, there is real risk that governments may finally get serious and start imposing policies and regulations that cut into their profits and power.

Corporations are of course fighting back, big time, with a unified greenwashing campaign to rebrand themselves as the purveyors of solutions. Not a day goes buy without the announcement of a corporate initiative or pledge to achieve the Paris target of "net zero" emissions by 2050. But a look into the net zero roadmaps, blueprints and scenarios that more and more corporations are making public shows that their version of net zero is really just a commitment to maintain the growth of their highly-polluting operations and to (possibly) offset these emissions by paying others to suck carbon out of the atmosphere. The plans are scientifically unsound and place most of the burden and risk on communities in the global South, whose lands will be targetted for these offset programmes.

6

Corporations from across all sectors, including the powerful financial industry, are aggressively promoting this net zero scam as a way to avoid regulations on their operations. For instance, 545 financial companies, with a combined $52 trillion in assets under management, recently launched the ‘Climate Action 100+’ initiative to “ensure the world’s largest corporate greenhouse gas emitters” move towards net zero emissions by 2050.

7 At the same time, many of these corporations are lobbying hard against government intervention into their financing of polluting companies, insisting that somehow they are best placed to decide how investment in climate solutions should be allocated.

8 The engagement from the financial sector, even though it is mere greenwashing, puts added pressure on corporations to disclose their emissions and commit to net zero, so as to satisfy the hands that feed them. This is the main reason why we are seeing a flurry of corporate pledges for net zero, including from the food and agribusiness sector. This shift in corporate greenwashing, so deeply based on offsets, is shaping up to be even worse than the days of climate denial.

Net zero is worse than nothing

BlackRock is the world’s largest and most influential shareholder of both fossil fuel and agribusiness corporations.

9 Despite its deep integration with the world's worst climate villains, BlackRock has recast itself as a leader for climate action, and was even recently hired by the EU to oversee its sustainable finance agenda.

10 BlackRock says it now “expects companies to articulate how they are aligned to a scenario in which global warming is limited to well below 2°C, consistent with a global aspiration to reach net zero greenhouse gas (GHG) emissions by 2050”.

11 But what does it mean in practice for a company financed by BlackRock to align with "net zero"?

Demonstration against green capitalism in Xapuri. Photo: World Rainforest Movement

One of the corporations that BlackRock is heavily invested in is Nestlé, the world's largest food company and one of the worst corporate GHG emitters outside of the energy sector.

12 BlackRock is Nestlé's largest shareholder and, despite Nestlés massive climate footprint, the company is an easy fit with the actions BlackRock "expects" from the companies it invests in. The Swiss company is one of the rare dairy corporations to commit to net zero emissions by 2050 from its full operations, including those from its supply chain (known as Scope 3).

13 In December 2020, Nestlé launched its “Net Zero Roadmap”, committing to reduce its emissions by 50% by 2030 and to "net zero" by 2050. The majority of these emissions occur in its supply chain, especially in the sourcing of dairy, meat and commodity crops (coffee, palm oil, sugar, soybeans, etc).

14 Nestlé's annual Scope 3 emissions are roughly double the total emissions of its home country, Switzerland.

15

Nestlé's climate plan does not involve a reduction in its sales of foods based on dairy, meat and other highly-emitting agricultural commodities. To the contrary, its climate plan is based on a projected growth of 68 per cent for both its sourcing of dairy and livestock products and of commodity crops between 2020 and 2030.

16 It claims, however, that this growth in production will be more than compensated by the deployment of climate-friendly technologies and changes to farming practices among its farmer suppliers.

To achieve this hugely ambitious transformation in its agricultural supply chain, Nestlé announced a commitment to invest US$1.2 billion over the next ten years in "regenerative agriculture practices". To put this into perspective: Nestlé paid out a dividend of around US$8 billion to BlackRock and its other shareholders in 2020. On an annual basis, Nestlé's big commitment to change the farming practices of its suppliers is a paltry 1.5% of what it pays its shareholders in dividends or three times less what it pays BlackRock in dividends.

17

Apart from the meagre resources it allocates, the company is also very vague on how it will ensure these regenerative practices are implemented. In the case of dairy and livestock, Nestlé wants to do research on feed additives to cut the methane produced by animals and get farmers to use more sustainably produced animal feed. And in the case of their coffee and cacao they want farmers to get into agroforestry and better soil management. But many of these supposedly climate-friendly technologies are unproved and there is no clear plan on how suppliers will transition to regenerative practices and who will pay for that to happen.

In the absence of any serious commitment to reduce its supply chain emissions, Nestlé's banking on offsets to salvage its net zero ambitions. "We see enormous potential for the removal of GHG emissions from the atmosphere as a way to counterbalance those emissions that we cannot reduce directly," says Nestlé in its Roadmap.

The company estimates it will need to offset 13 million tonnes of CO2e per year by 2030, an amount roughly the size of the total annual GHG emissions for a small country like Latvia.

18 But this number could be even higher if its efforts to reduce emissions through "regenerative agriculture" do not materialise. One of the initiatives to reduce emissions in agriculture that Nestlé is involved with is a programme, designed by the fertiliser industry to reduce emissions from nitrogen fertilisers in North America.

19 In Canada, where the "4R Nutrient Stewardship Programme" was initiated, studies show that participating farmers actually end up using more fertilisers and using them more inefficiently.

20

Nature-based destruction

Nestlé's Roadmap is pretty much a carbon copy of the other net zero pledges that have been streaming forth from agribusiness and fossil fuel corporations over the past year or so. All of them are based on the continued growth in sales of their highly polluting products, offset by payments to others to suck carbon back into the ground, primarily by protecting forests that are in danger of being cut down or by planting trees on degraded lands.

Corporations are now collectively referring to these offsets as "nature-based solutions".

21

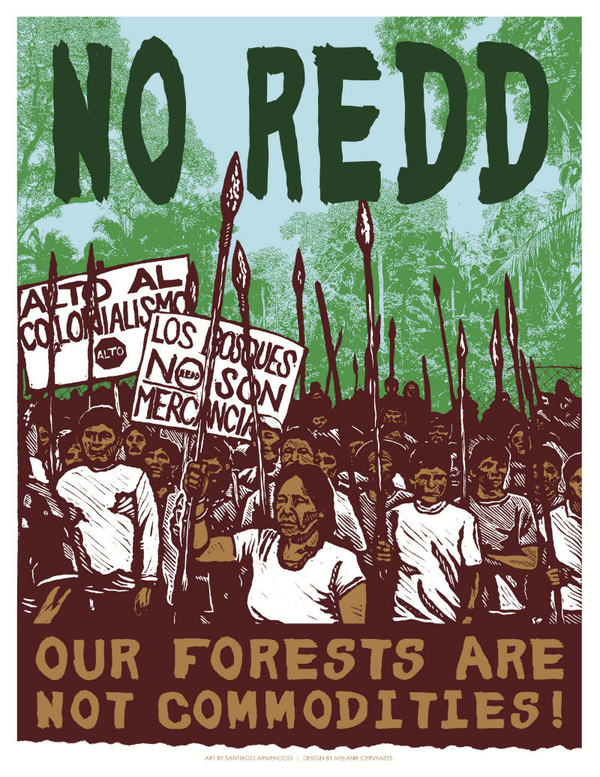

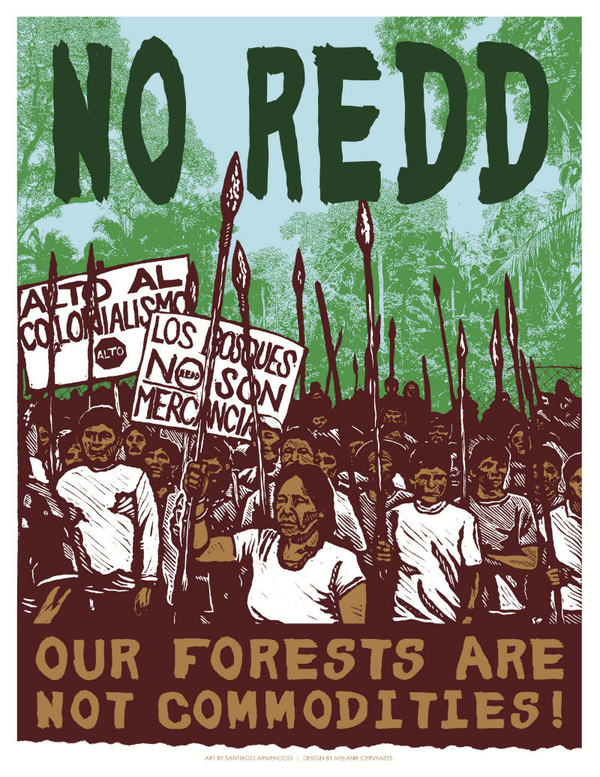

The precursor to today's "nature-based solutions" is the UN's Reducing Emissions from Deforestation and Forest Degradation (REDD+) programme, which not only failed to reduce deforestation or emissions over the past twelve years, but also badly affected local communities, especially by cutting off their access to agricultural lands and forests and contributing to land conflicts.

22

Image: Art by Santiago Armengod, Design by Melanie Cervantes

One of the early promoters of REDD+ was a Swiss company, South Pole Group, which is now working for Nestlé on its offset plan.23 South Pole lead the huge Kariba REDD project, covering 784,987 hectares in northwestern Zimbabwe. That project, which was structured to channel money through several companies registered in tax havens, failed to bring any material benefits to local communities and worse, prevented them from accessing the lands they depend on for food production, hunting and gathering.24 It did succeed, however, in providing the French energy giant Total with offsets to make its liquid natural gas shipments to China "carbon neutral".

The South Pole Group is one of a small number of corporations that stand to make a killing from the growing corporate reliance on offsets. Nestlé, an offset buyer, paid South Pole to develop a model for it "to calculate the GHG mitigation potential of agricultural land."

25 At the same time, South Pole contracts with potential offset sellers, like the UK's Miro Forestry, which hired South Pole to certify the carbon absorption of its massive tree plantations in West Africa and help it sell offsets. South Pole, described as "one of the largest traders in carbon credits", gets paid making the calculations for companies on both sides of the ledger and then, if all goes well, arranging the trades.

26

Another important actor promoting ’nature-based solutions' is the UK-based company SYSTEMIQ. This little-known company, founded and run by former executives of the global consulting firm McKinsey, oversaw the hugely influential Business & Sustainable Development Commission, a two-year initiative that was launched by the food giant Unilever and other corporations in Davos in 2016. [27] One of the offshoots of that initiative was the Food and Land Use Coalition (FOLU)-- also co-founded by Unilever and handed to SYSTEMIQ to manage. FOLU has become perhaps the most important promoter of corporate "nature-based solutions" (see Box: FOLU: Yara and Unilever's new clothes). Both the Business & Sustainable Development Commission and FOLU have received much of their funding from the Norwegian government, which needs offsets for its own oil business. Shareholders of SYSTEMIQ include major heavyweights in international climate discussions like Lord Nicholas Stern, Sir David King, Janez Potočnik and Thomas Heller, as well as influential billionaires Jeremy Grantham, André Hoffman and George Soros. [28]

This new corporate chorus clamouring for "nature-based solutions” may well just end up being greenwashing, serving mainly to distract from and delay real emissions reductions. But if the rapidly growing number of corporate net zero plans do move to implementation, even only partially, it will in our opinion result in a massive grab of lands, forests and territories of Indigenous Peoples and rural communities in the global South. [29]

Nestlé's stated ambition to offset 13 MT CO2e a year of emissions with "nature-based solutions" would require zoning off or planting trees on at least 4.4 million hectares of lands every year.

30 The Italian energy company Eni says it will need nearly twice this amount per year by 2030, and is already advancing with plans to establish tree plantations on over 8.1 million hectares in Africa.

31 Same goes with the oil major Shell, whose new net zero scenario commits the company to more fossil fuel extraction and a massive scaling-up in "nature-based solutions" to offset its resulting emissions. Shell's offsets will require at least 8.5 million hectares of land per year by 2035.

32 Just these three companies will need about 20 million hectares per year for their collective offset needs-- an area roughly the size of all the forested lands in Malaysia, every year!

All of this for what? There is no way to truly get to a point of net zero emissions, where the amount of GHG being emitted into the atmosphere is no more than the amount being drawn out of the atmosphere, if the emissions from the burning of fossil fuels and other major sources of GHGs are not reduced to near zero. For all of the damage that the coming offset land grabs will inflict on communities in the global South, nothing will be done to stop global warming. As stated in a newly released report by La Via Campesina and a coalition of other NGOs and social movements, the corporate net zero plans and pledges that are coming fast and furiously these days make it crystal clear that "

there is no desire or ambition on the part of the largest and richest in the world to actually reduce emissions. 'Greenwashing' hardly suffices as a term to describe these efforts to obscure continued growth in fossil emissions – 'ecocide' and 'genocide' more accurately capture the impacts the world will face."

33

FOLU: Yara and Unilever's new clothes

One of today's most sophisticated and covert lobbies for the food and agribusiness corporations is the Food and Land Use Coalition (FOLU). It was initiated by the Norwegian fertiliser company Yara and the Anglo-Dutch processed-food giant Unilever-- two of the worst climate polluters within the food and agriculture sector.

34 With backing from the Norwegian government, also one of the world's worst climate polluters, they engaged a private company run by ex-McKinsey executives to bring together a coalition of the usual suspects of corporate-funded NGOs and business associations.

35 Today FOLU, and the individuals and groups that inhabit it, are ubiquitous in international fora dealing with climate and food.

36

FOLU describes itself as a "community of organisations and individuals" but its agenda is firmly anchored in the interests of its two founding corporations. Unilever, the world's largest buyer of palm oil, has for years been promoting certification schemes, notably the Roundtable on Sustainable Palm Oil, to provide itself a "sustainable" source for a fundamentally unsustainable agricultural commodity. Yara, as the world's largest producer of nitrogen fertiliser, a product that alone accounts for one in every 50 tonnes of global GHG emissions produced by humans per year, has led a campaign to recast its fertilisers as climate saviours. Yara says its fertilisers have enabled people to produce more food on less land, thereby saving forests and cooling the planet.

37

Not surprisingly, then, FOLU calls for voluntary certification schemes and more efficient, fossil-fuel-based agricultural production as the main solutions to the food sector's climate emissions. It also puts the focus on reducing tropical deforestation, not eliminating fossil fuels from the food system, and expects this to be paid for by corporations in need of offsets for their net zero commitments.

38

Both Yara and Unilever have long been united in their desire to maintain and expand the industrial production of agricultural commodities. Prior to FOLU, they initiated the Global Alliance for Climate Smart Agriculture-- launched in 2014 by then US Secretary of State John Kerry and then special adviser to the United Nations Secretary-General David Nabarro at the United Nations Summit on Climate Change in New York.

39 That alliance, which had a similar membership to FOLU, was a failure in terms of climate action, but that was never its intention. The alliance was conceived to block efforts to push real solutions like agroecology and food sovereignty in the international fora dealing with food, agriculture and climate.

40

The climate revolution will not be financed

We should not be surprised by this new wave of corporate greenwashing. A recent study by a business consultancy came to the embarrassing conclusion that the past two decades of corporate "sustainability" programmes have a 98% failure rate.

41 Corporations are simply not going to take actions that impede their profits, and they will fight against any actors, be they governments or frontline communities, that stand in their way. They will only change when forced to.

While it is tempting to celebrate the recent spate of corporate pledges to address the climate crisis as a victory for social movements, it is more important that we take stock of how these pledges are really just smokescreens designed to maintain business-as-usual. The reality is that corporations will not and cannot be part of the solution.

Climate demonstration in San Francisco, USA, 2019. Photo: Climate Justice Alliance Vimeo video "Defend the Sacred, End Climate Capitalism, and Support Community Solutions from the Frontlines”

This is particularly important to keep in mind with the financial industry.42 Financial corporations like BlackRock and even the corporations that manage pension funds are built to finance corporations. If money is left in their hands, it will always flow to corporations. Corporations may have to make net zero pledges to access that money, but this is not going to drive down emissions and will take a huge toll on communities that have done nothing to contribute to the climate crisis. There is no victory for people or the climate if a financial company is shamed into shifting its holdings from Exxon to Nestlé. This is not to dismiss the significance of divestment campaigns, which can have important impacts on a range of issues. But there's a difference between demanding financial companies divest and calling on them to invest in solutions.

Solutions must be developed and defined by people not corporations. When it comes to food and agriculture, peasants and other small-scale food producers have already articulated a vision for food sovereignty and solutions to the climate crisis that excludes these huge corporations altogether.

43 There is no place in this vision for Nestlé’s Roadmap, Unilever's "nature-based solutions" or BlackRock's empty environmental promises.

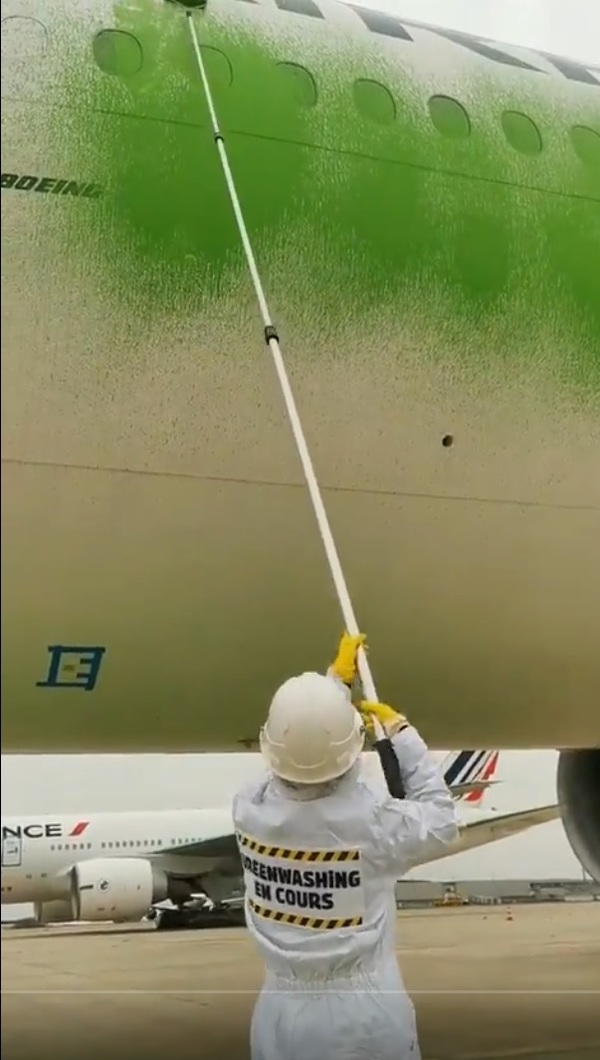

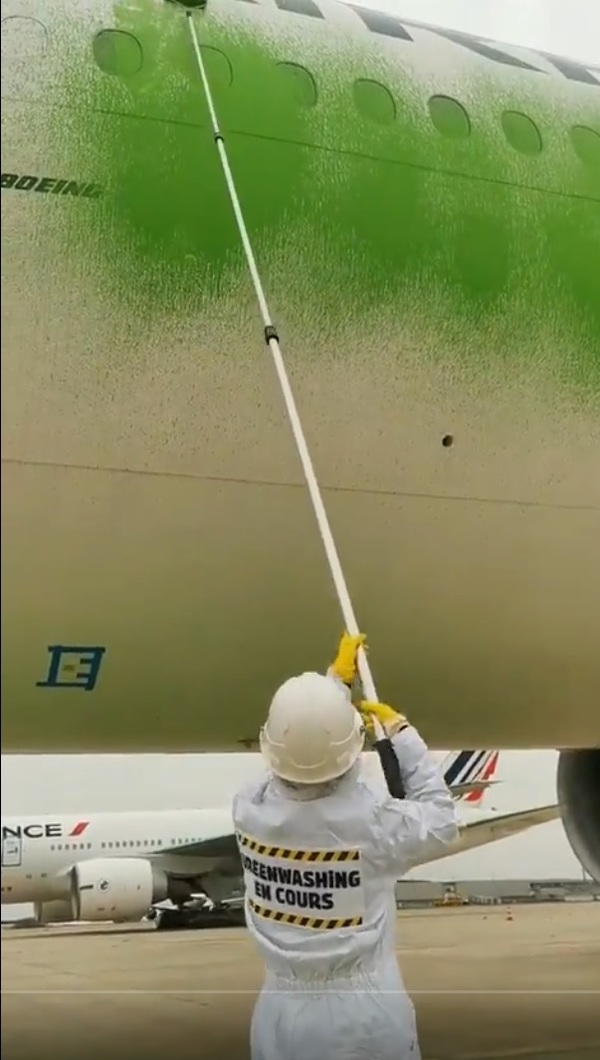

Greenpeace greenwashing action against Air France, 5 March 2021. Photo: Greenpeace France Twitter

We have to confront the rising tsunami of corporate, greenwashed solutions with clarity and solidarity. Offsets must be rejected full-stop, as must any scheme that makes allowance for them, such as "nature-based solutions".

44 The focus needs to be on system change; just substituting one energy source for another, or one technology for another, only changes corporate squabbles for control over new energy sources and technologies and displaces the site of the damage. Imagine the amount of land, water and natural resources or “nature based solutions”, including with the use of fossil fuels, needed for the production of agrofuels/biofuels or the installation of hydroelectric plants or wind farms to replace the current and future global demand for fossil fuels? We need to stop any kind of extractivism, including the extractivism of industrial agriculture and fisheries.

We also have to challenge the corporate monopoly over "investment". Yes, investment is needed to transition out of fossil fuels but this is never going to happen if investment is left to global financial corporations whose primary function is to channel the retirement savings of workers to corporations in the form of share purchases and bonds. Pension funds account for half of all the money in the global financial system and, not only do these funds support the worst corporate polluters, but they are increasingly engaged in evils such as land grabbing, private equity and the privatisation of health services and infrastructure.

45 These deferred wages, now worth over US$50 trillion and managed by a few dozen corporate fund managers, are more than enough to cover the estimated costs of solving the climate crisis.

46 But they will continue to fund climate destruction if left in the hands of financial corporations.

The problem we are confronted with is not how to get the BlackRocks or Nestlés of this world to invest in solutions to the climate crisis. It is how to take back control over the funds, resources and governments that are currently captured by corporations in order to support genuine solutions to the climate crisis that serve the needs of people.