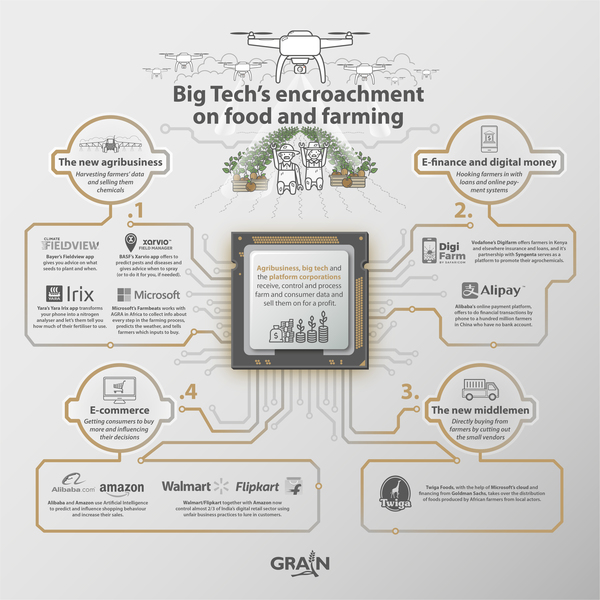

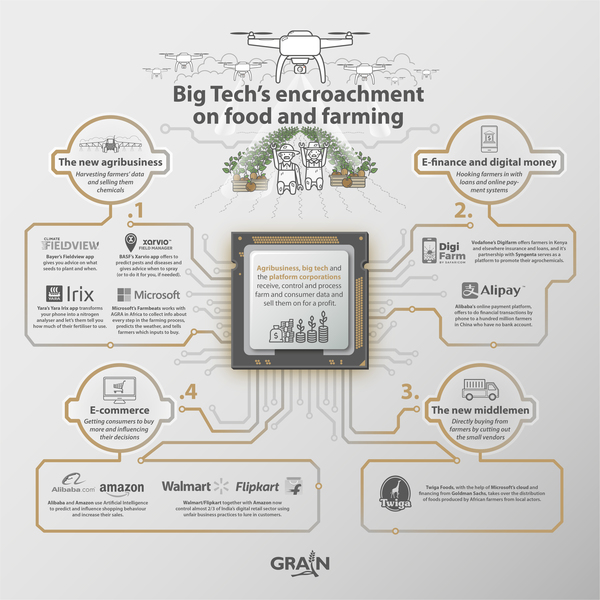

The world’s biggest technology companies and distribution platforms, such as Microsoft and Amazon, have started entering the food sector. What does this mean for small farmers and local food systems?

It leads to a strong and powerful integration between the companies that supply products to farmers (pesticides, tractors, drones, etc) and those that control the flow of data and have access to food consumers.

On the input side, agribusiness are joining the trend of getting farmers to use their mobile phone apps to supply them with data, on the basis that they can give ‘advice’ to the farmers.

On the output side, big e-platform corporations can be seen buying their way into the sector and taking control of food distribution.

Together, they favour the use of chemical inputs and costly machinery, as well as the production of commodities for corporate buyers not local markets. They encourage centralisation, concentration and uniformity, and are prone to abusing their power and monopolisation.

A few years ago, the Japanese tech company Fujitsu erected a pilot, vertical farm on a parcel of land outside of Hanoi. The high-tech farm, which looks more like a factory, produces lettuce on stacked shelves in a completely enclosed high-tech greenhouse managed by central computers in Japan. The computers are connected to a cloud that Fujitsu operates in partnership with one of Japan's largest food retailers, Aeon. The farm is at once impressive and confounding-- such an enormous amount of resources and energy going into the production of a few trays of low-value lettuce.

The unlikely economics of vertical farming has not diminished its appeal in Silicon Valley. Since 2014, vertical farm start-ups have raked in US$1.8 billion from tech investors like of Amazon founder Jeff Bezos and Japan's SoftBank. This is an amount larger than all annual foreign direct investment flows into agriculture. Yet, despite the huge cash inflows, the high-tech farms these companies have built only occupy the equivalent of a measly 30 hectares of land worldwide. Hardly a game changer for global food production.

Just down the road from its vertical farm on the outskirts of Hanoi, Fujitsu is piloting another farm that offers a different and more realistic vision for how technology companies are moving into agriculture. This farm is located on an ordinary, outdoor field, indistinguishable from neighbouring farms. The only significant difference is that all workers on the Fujitsu farm carry smartphones supplied by the company and their movements are being monitored. The hours they work, their productivity, and the inputs they apply are carefully logged and registered in Japan on the company's cloud. Fujitsu is deploying the latest in digital technology to the age-old corporate imperative of maximising labour exploitation.

Fujitsu farm in Hanoi, Vietnam (2016). Source: GRAIN

It is critical that we look beyond the hype. Yes, digital technologies can be made to work for farmers, consumers, farm workers and the environment. But technology does not develop in a bubble; it is shaped by money and power-- both of which are extremely concentrated in the tech sector. In an era where only a few corporations hold unprecedented control over data, communications and the food system, digital agriculture will evolve in ways that reinforce their power and profits- unless we organise to actively prevent this from happening.

Harvesting data

In the digital tech world, power is based on data-- the capacity to collect and process massive amounts of it. So, just as with other sectors of the economy, large corporations-- be they tech companies, telecoms providers, retail chains, food companies, agribusinesses, or banks-- are racing to collect as much data as they can from all nodes of the food system, and to find ways to profit from this data. These efforts are getting more and more integrated and connected, through corporate partnerships, mergers and take-overs, creating the possibilities for a much more profound and complete corporate capture of the food system.

By far, the biggest players in this mix are the global technology companies, known as Big Tech. Table 1 lists some of their moves into the food sector. They are new to agriculture but are beginning to invest heavily in it, especially into digital information platforms connected to their cloud services.

Microsoft, for instance, is building up a digital farming platform called Azure FarmBeats that operates through the company's massive, global cloud technology, Azure.

4 The platform is being designed to provide farmers with real-time data and analysis on the condition of their soils and water, the growth of their crops, the situation with pests and diseases and the looming weather and climatic changes they may face. The value of this information and advice depends on the volume and quality of data that Microsoft can harvest and analyse with algorithms. This is why Microsoft is partnering with leading companies developing farm drones and sensory devices, as well as with those companies developing technologies that can receive and act upon the information transmitted from FarmBeats; the high-tech tractors, pesticide-spraying drones and other machines hooked up to the Azure cloud.

Agribusiness companies, especially those that sell seeds, pesticides and fertilisers, have a head start on Big Tech. The biggest agribusiness players all have apps, now covering millions of hectares of farms, that get farmers to supply them data in exchange for advice and discounts on the application of their products (see box: Agribusiness goes digital). Bayer, the world's largest pesticide and seed company, says its app is already being used on farms covering over 24 million hectares in the US, Canada, Brazil, Europe and Argentina.

Sheikh Mohammed bin Rashid, Vice President and Prime Minister of the United Arab Emirates, and ruler of the Emirate of Dubai at GITEX2020 finding out about Azure FarmBeats. Credit: Microsoft UAE twitter account

Bayer, like the other agribusiness companies, has to lease the digital infrastructure it needs to run its app from one of the Big Tech companies that control the world's cloud services. In this case, it is Amazon Web Services (AWS), the world's largest cloud service platform, ahead of Microsoft, Google and Alibaba. Amazon, like Microsoft, is developing its own digital agriculture platform, which can potentially tap into the data collected by Bayer and numerous other companies that use its cloud services. It thus has a huge advantage over these companies, not only in terms of the amount of data it can access, but also in terms of its capacity to analyse this data and ultimately profit from it. The logic then, which we are already starting to see play out, is towards an integration between the companies that supply products to farmers (pesticides, tractors, drones, etc) and those that control the flow of data.

Agribusiness goes digital

The last few years have seen an explosion of mobile apps being offered to farmers by pesticide and fertiliser companies to ‘help’ them take decisions on what to plant, how much to spray, when to harvest, amongst other things.

When Monsanto bought up the Climate Corporation back in 2013 for almost one billion dollars, many scratched their head. Why would an agrochemical corporation buy up a company that sells weather insurance to farmers? Part of the answer is in “Climate FieldView”, a series of mobile phone apps that the company was working on to get farmers to submit data about their fields in return for advice on what and when to plant. Monsanto claimed then that “data science” could be a $20 billion revenue opportunity beyond its core business of seeds and chemicals.

7

Fieldview is now functional, though mostly in the US.

8 Meanwhile, Monsanto was taken over by Bayer, integrating even more "data science". The strategy to get farmers to submit data in return for ‘advice’ seems to be interesting for any company that aims to sell chemical inputs to farmers. The way the system works is basically as follows:

You open a Fieldview account online and upload historical field data (normally provided by a service company in your area) and all kind of other data (such as info on planting, spraying, seeds used, etc.).

Then you install the “cab-app” on your tractor, a small tracking device that captures data on all kinds of things the tractor does on the field, and uploads the data to the company’s Fieldview drive in the cloud. From now on, Bayer has access to all farming data that the you capture and upload (seed density, fertiliser and chemical use, etc.).

Bayer will then overlay your info with its data sets on soil quality, pests and disease, weather, humidity, etc., and recommend what you should buy from them to deal with any problems - all on your app.

You can link your Fieldview account with Bayer’s “PLUS Rewards” and get discounts and services linked to any chemicals they can get you to buy, including their flagship herbicide “Roundup”.

Disclaimer: this only works with maize and soybeans

Bayer is just one of the companies that aim to get direct access to their customers fields to sell their products. BASF offers their Xarvio app to do the same.

9 Their “scout” helps you identify weeds, diseases, insects, etc. in your field and predicts when they will become a problem. The “field manager” will tell you when to spray and fertilise, how much, and- if you want it (and for an extra fee)- the “healthy fields” app offers you to “leave the planning, implementing and documenting of crop protection activities to us.” BASF then sends the sprayers to your fields when they decide it’s needed.

In 2019, Syngenta bought Cropio, adding Eastern Europe's leading digital agricultural company to its rapidly expanding CropWise digital platform. Syngenta boasted that, with the acquisition of Cropbio, it was "the only agricultural company to have access to leading management platforms in the top four agriculture markets: in the United States with Land.db, Brazil with Strider, China with the Modern Agricultural Platform and now Eastern Europe with Cropio. When combined, more than 40 million hectares globally will be managed using a Syngenta digital tool, with plans for this to double by the end of 2020.”

10

Not to stay behind, Yara – the largest fertilizer company in the world, offers a whole set of digital tools to assess your fertiliser needs such as Yaralrix which transforms your phone into a nitrogen analyser. Another is Atfarm, which allows you to analyse your fields with satellite images and selectively apply fertilizer. And of course, once you know what you need, Yara is on hand to sell you the product.

11

A digital divide

All of this may sound quite disconnected from the realities and needs of the 500 million or so small farm households in the world who produce much of the world's food. High-tech applications, like driverless tractors and pesticide spraying drones, are clearly not being developed for them. More importantly, the quality of the information that digital platforms provide to farmers is only as good as the data collected. So, for farms in areas where there is a lot of data collection (regular soil tests, field studies, yield measurements, etc) and for farms that can afford new technologies that collect data (like new tractors, drones, and field sensors), tech companies can collect large volumes of high-quality, real-time data. They have been developing algorithms to process and analyse the data and claim they can provide these farmers with advice on fertiliser application, pesticide use, and harvest times that are fairly specific and useful to their farms. Nevertheless, it also makes a huge difference if the farms in the area are doing monocropping, because this makes it vastly more simple for data collection and analysis, as well as for recommendations.

Small farms, however, tend to be located in areas where there are minimal to no extension services and hardly any central collection of field data. These services have been gutted across the Global South through decades of structural adjustment. Nor can small farms afford the high-priced data gathering technologies that bigger farms can use to feed information to the cloud. As a result, the data that tech companies collect on small farms will inevitably be of very poor quality.

Tech companies and the governments promoting digital agriculture are not working to address this lack of field data on small farms. While money, especially public money, is going into the infrastructure connecting rural people to mobile and internet networks, including the new race to 5G, no new money is going into state agriculture extension services. If anything, the input suppliers- that currently provide some minimal extension to farmers that purchase their products- are looking to digital agriculture to cut back on their presence in the field. The plan is instead to work around this information gap, to use satellite data and whatever hodgepodge of field data can be collected from the private and public agronomists, NGOs and food companies that still visit farmers.

The advice small farmers will get from such digital networks, via text messages on their cell phones, will be far from revolutionary. And, if these farmers are practicing agroecology and mixed cropping, any advice they receive will be completely useless. But good advice to farmers is not really the end game here anyway. For the corporations investing in digital agriculture, the objective is to integrate millions of small farmers into a vast, centrally controlled digital network. Once integrated, they are heavily encouraged- if not obligated- to buy their products (inputs, machinery, and financial services) and to supply them with agricultural commodities that they can then sell onwards.

A cloud on the horizon

Over the past two decades, Microsoft's owner, Bill Gates, has sunk a huge part of his fortune into trying to get small farmers in the Global South to adopt what they claim to be “the most highly advanced seeds, pesticides and fertilisers”, sold and developed by the world's largest agribusiness corporations. Despite having invested millions, if not billions, into the international research centres promoting these technologies and programmes like the Alliance for a Green Revolution in Africa (AGRA), his efforts have had little impact, and adoption rates for the technologies remain low.

Gates is banking that digital agriculture can turn things around. In September 2020, Microsoft and AGRA formalised a partnership to help Microsoft expand its Azure FarmBeats platform across the continent and deepen their joint efforts to deploy Microsoft's "chatbot" app Kuzabot. This app provides small farmers with advice via WhatsApp and SMS, including information on what inputs to use and which companies to buy from. Microsoft had an earlier partnership with the Gates-funded International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) in India with a similar app that provided farmers advice on when to sow their seeds, and was rolled out through the agricultural extension services of the Government of the State of Karnataka.

At the same time, Microsoft's FarmBeats is integrating the US-based start-up Climate Edge into its platform. Climate Edge describes itself as "a big data broker for the developing agriculture sector". Essentially, it aggregates data on small farmers supplied by agricultural consultants, NGOs, companies, and researchers that use its platform and then sells this information onwards to insurance companies, certification bodies, pesticide dealers, large food companies like Unilever and even NGOs who want to prove their projects have boosted yields.

Microsoft and its partners are not alone in developing digital data and communications platforms that they can then sell to pesticide companies and other actors who want to influence farmer choices. The leading provider of "chatbot" advisory services to small farmers in Kenya, Arifu, has the multinational seeds and pesticides company Syngenta as a partner. Arifu says its digital platform "creates a feedback loop by generating a demand for Syngenta seeds ... Through Arifu, they can reach a population for which they would have otherwise needed costly and scarce ground ambassadors." But costs savings for input companies like Syngenta are just the tip of the iceberg of the profits that can be made for those who control the growing digital agriculture space.

Twiga warehouse. Source: Global Agriculture & Food Security Program website

Arifu is now part of a larger digital platform in Kenya called Digifarm, operated by Vodafone's Kenyan subsidiary Safaricom. Digifarm provides millions of small farmers in Kenya with chatbot services like Arifu, sells them inputs and crop insurance, offers them loans and buys and sells their produce, all via Safaricom's national digital money platform, M-PESA. For this, Safaricom charges a fee on all transactions (see box: Banking on rural communities).

Digifarm, and similar platforms in other parts of the world, are being hailed for providing financial services to rural people who would not otherwise be able to access them (so called "banking the un-bankable"). But this obscures what is really happening. These platforms are not making the knowledge of small farmers or their diverse seed and animal varieties "bankable". To become bankable, farmers must conform to the system-- they must buy the inputs that are promoted and sold on credit (at high interest rates), follow the "advice" of the chatbot to qualify for crop insurance (which they must pay for), sell their crops to the company (at a non-negotiable price), and receive payments on a digital money app (for which there is a fee). Any missteps can affect a farmer's credit worthiness and access to finance and markets. It's contract farming on a mass scale.

“I...followed all the training lessons,” said Wilson Kibet, a 50-year old Kenyan farmer who took a loan from Digifarm at 15% interest to buy a package of hybrid maize seeds and chemical inputs and who followed the advice provided. “They even told us not to plant beans in the middle of maize rows.”

Banking on rural communities

In November 2020, Brazil launched a nation-wide digital platform for payments and instant transfers, called Pix. With the new application installed on their mobile phones, Brazilians can now make payments and money transfers 24 hours a day, 7 days a week, without the need for a bank account.

21 Today, an estimated 60 million Brazilians, or 35% of the population, do not have a bank account because they cannot afford bank fees, lack a fixed address or the required personal documents, or live in isolated rural communities too far from bank branches. But many of these people have mobile phones, and can access Pix.

The situation is similar elsewhere. According to the World Bank, there are 1.7 billion people without bank accounts around the world, of whom 1.1 billion have mobile phones. There is thus a huge potential financial market that tech companies, known as fintechs, can tap into, displacing the traditional giants of the financial system.

China alone has roughly 224 million people without bank accounts and the nation's two tech giants, Alibaba and Tencent, have been aggressively moving ahead with plans to integrate their dominant e-commerce platforms, digital payment apps and micro-lending divisions-- which, for a fee, broker micro loans with banks based on the shopping data compiled on individual consumers. The potential profit is immense, and explains why Alibaba's micro-lending arm, Ant, raised a record smashing US$3 trillion in bids on its initial public offering (IPO) in October 2020, the largest IPO in history. Concerns about how such concentrated power and loose oversight with credit could harm the larger economy pushed the Chinese government to bring forward new antitrust rules on fintech, leading Ant to withdraw its IPO at the last minute.

22

Monopoly control is not the only concern. Digital money creates new possibilities for theft, fraud and indebtedness, leaving those with little experience with banking and finance especially vulnerable. It also creates the potential for more state surveillance and control, as is the case in China, where projects are being developed to integrate digital money platforms with state efforts to control people's behaviour.

23 And farmers should question what it means when a company like Alibaba, with its growing control over people's shopping habits, is partnering with the largest industrial farming companies to develop artificial intelligence for their factory pig farms.

24

The new middlemen

Another supposed benefit for farmers from these emerging digital platforms is that they eliminate dependence on "middlemen". True, farmers are finding creative ways to use digital platforms to sell directly to consumers, especially during the current COVID-19 virus pandemic, and there is also plenty of potential for farmers to use digital technology to strengthen their negotiating power, especially if they do so through cooperatives or other collective structures. But, even in such positive cases, people still need to do the "middle" work of collecting, distributing and selling the foods produced on the farm, and in much of the world, that work is still done by millions of small scale traders and vendors, most of whom are women, selling food in nearby towns.

It would be great if digital platforms could be designed to help these two poles-- farmers and small vendors— to better communicate and coordinate food chains and to eliminate the greedy corporations and cartels that often sit in between. This, however, is not in the interests of the corporations rolling out today's digital agriculture platforms. They will use their digital platforms to increase their pricing power over farmers (see box: Beware farmers: Singapore is watching!) and to bring labourers in the extended "middle" of the food system under the control of their invisible command centres. This is akin to what Uber has done with taxis, or what Rappi and iFood have done with online grocery and restaurant deliveries in Latin America. In particular, women traders and vendors of the food system will be rendered to piece workers for the Big Tech companies, as well as consumers of their financial products, paying fees for digital money transactions and interest on micro-credit loans.

Consider Twiga Foods, one of several agri-tech start-up companies seed-funded by Microsoft's 4Afrika programme. It was founded by a US academic who, while studying Nairobi's wholesale markets, became convinced of the potential for connecting farmers directly to small vendors, bypassing the powerful cartels. Backed by the World Bank, Microsoft and some other venture capital, Twiga Foods built up a fleet of trucks to source foods from farmers outside of Nairobi, to then be delivered directly to a network of small vendors in the city. All of the transactions are organised through cell phones, payments included, and are run on Microsoft's digital platform and Azure’s cloud services.

Twiga Foods Cofounder Grant Brooke. Source: www.1776

Twiga's early success caught the attention of larger companies, looking for a way to finally break into Africa's growing consumer market. Goldman Sachs and the French family that owns the Auchan supermarkets took major stakes in the company. Twiga partnered with IBM, another top cloud services provider, to pilot a digital banking scheme with its vendors. And, most recently, Twiga formed a partnership with Kenya's top e-commerce retailer meaning that Twiga is now selling foods directly to consumers; cutting out the small vendors it was initially established to serve. Twiga also says it plans to "leverage" Auchan's rapidly growing supermarket network to expand into West Africa.

Twiga may have created some efficiencies in Kenya's food distribution system, but those savings are not being passed on to farmers and vendors. Twiga's more significant impact is that is has refashioned food distribution, using pretty much the same work force, to enable corporations to insert themselves in the middle and extract wealth.

The path that corporations are steering digital agriculture and food distribution down dovetails with larger retail developments. The COVID-19 pandemic is accelerating a shift towards online retail sales for food that Big Tech companies like Alibaba and Amazon have been aggressively pushing for (see box: How Big Tech and artificial intelligence control our shopping). As these companies try to assert themselves in countries where food retail is still largely in the hands of small vendor networks and traders and/or state regulated wholesale systems, they are heavily promoting digital platforms as a preferable marketing option for farmers, while concealing their own monopolistic ambitions.

In India, for instance, where a hard fought battle has been raging for years to keep big retail chains out of the country, corporations are now colonising the retail space through e-commerce. Walmart entered into India in 2016 by a US$3.3 billion take-over of the online retail start-up Jet.com which, in 2018, was followed by a US$16 billion take-over of India’s largest online retail platform Flipkart. Amazon is not far behind. Today, Walmart and Amazon now control almost two thirds of India’s digital retail sector.

The corporate expansion of online retail in India is a direct threat to millions of hawkers, small traders and retailers, kirana stores, and mom & pop shops. Amazon and Walmart are using predatory pricing, deep discounts and other unfair business practices to lure customers towards their online platforms. When the two companies generated sales of over US$3 billion in just six days during a Diwali festival sales blitz, India's small retailers called out in desperation for a boycott of online shopping.

But more corporations are coming to get a piece of India’s growing digital retail market. In 2020 Facebook and the US-based private equity giant KKR committed over US$7 billion to Reliance Jio, the digital store of one of India’s biggest retail stores. Customers will soon be able to shop at Reliance Jio through Facebook's chat application, WhatsApp.

Although online shopping has not taken off in Latin America as in some other regions, its current growth is tremendous. It is driven by the expansion of mobile phone delivery apps such as “Rappi” which offers a whole range of services, from food to pharmacy and from banking to books, to just mention a few. The company has witnessed an extraordinary growth in Latin America, duplicating its size every four or five months, and spreading to nine countries in the region in the last five years only. Its slogan is “We run for you”, and it is now valued at US$3.5 billion. According to Luis Techera of Rappi Mexico, their strategic value lies in the information they collect about the shopping behaviour of their customers: “If for example Gillette wants to launch a new shaving machine, they can ask Rappi to approach 100,000 people that bought a Gilette razor in the past, are between 27 and 35 years old and live in a certain area”.

Beware farmers: Singapore is watching!

In 2014, Singapore-based Olam, the world's third largest cocoa processor, launched what it calls the Olam Farmer Information System (OFIS) in Côte d’Ivoire and Ghana. Olam says its “technology allows field staff to survey and record, on the spot, thousands of farms, the surrounding landscape, as well as the farmer’s social circumstances.”

“

Data – including farm size, location, age of (tree) stock, economic, social and health infrastructure, and eco-support systems – is collected at farm-gate level on a hand-held device by Olam’s trained field staff … Olam field staff brief the farmers on how the data will potentially be used and assure them that any personal data would be available only to Olam staff and selected Olam customers under an appropriate Terms of Usage agreement and otherwise in strict confidence. After the briefing, the farmer either consents to provide relevant information or opts out from the exercise. The OFIS database is owned by Olam International Limited in Singapore and all personal data-related processes and protocols are in accordance with Singapore laws or practice. GPS is widely used to geotag farmers’ locations, plotting farms and mapping key social infrastructure points in the villages. The data from this mapping and the farmer surveys are fed via an Android OS application into Olam’s database and then visualized via an online maps interface and analysis graphing tool to generate reports.”32

Olam says it uses this data to help farmers maximise their productivity and avoid deforestation. It casually omits any mention of how it might use this intelligence gathering to push down prices and maximise its profits.

Small farmers in Ghana and Côte d’Ivoire are in a long-standing war with Olam and the other big traders over cocoa prices. The power asymmetry is such that these cocoa farmers earn a measly US$1.31 per day, well below the UN’s US$1.90 definition of extreme poverty, with a quarter of that coming from non-cocoa sources.

33 In October 2019, the governments of Ghana and Côte d’Ivoire took some action towards improving the situation by requiring the companies to pay a US$400-a-tonne “living income differential” to help increase payments to farmers (a step-down from their effort to set a minimum floor price, which was rejected by the companies). But, now, Ghana and Côte d’Ivoire say the big traders are already undermining the programme, including Olam. They say Olam, the world’s third largest cocoa processor, is deliberately reducing its purchases of beans from Ghana and Côte d’Ivoire to sabotage the “living income differential” programme.

34

How big tech and artificial intelligence control our shopping

Increasingly, the big food distribution platforms are using artificial intelligence (AI) software to predict our food preferences and get us to buy more.

Will Broome is the founder of Ubamarket, a UK firm that makes a shopping app that allows people to pay for items via their phones, make lists, and scan products for ingredients and allergens. "Our AI system tracks people's behaviour patterns rather than their purchases, and the more you shop the more the AI knows about what kinds of products you like," he says. "The AI module is designed not only to do the obvious stuff, but it learns as it goes along and becomes anticipatory". "With the app we have found that the average contents of a basket are up 20%, and people with the app are three times more likely to return to shop in that store," says Mr Broome.

Retail consultant Daniel Burke, of Blick Rothenberg, calls this "the holy grail... to build up a profile of customers and suggest a product before they realise it is what they wanted".

In Germany, a Berlin start-up called SO1 is doing similar things with its AI system for retailers. It claims that nine times more people buy AI-suggested goods than those offered by traditional promotions, even when the discounts are 30% less.

Online giant Amazon is no stranger to data collection. It has vast amounts of information on its customers from their online purchases and via its products such as its interactive Echo Dot speakers, which you can request to do things for you. It is now making a move into physical retailing, with bricks-and-mortar shops packed full of AI-aided computer vision technology. It means that, in its Amazon Go grocery stores currently up and running at 27 locations in the US, people can shop with no interaction with a human or a till. They simply swipe their smartphones on the scanner when they enter the supermarket, pick up what they want to buy, and then just walk out. The AI is watching of course and sends you a bill at the end.

When in 2017 Amazon bought up Whole Food Markets, a major organic food grocery network with over 400 shops across the US, it sent shivers through the sector. Amazon wants you to buy online but doesn’t care whether you want to get your food brought to your home or pick it up from the shop; they can do both now. Undoubtedly, soon they’ll be nudging you with what to buy, based on your preferences that they have stored in their giant databases.

More than three-quarters of large retailers around the world either have AI systems now in place, or plan to install them shortly, according to the research group Gartner. Its analyst Sandeep Unni says the global pandemic has accelerated this trend because it has dramatically changed consumer habits.

This might all sound nice and convenient for the customers who are into this, but for the corporations it’s even better as people tend to buy more as a response to personalised nudging. Also, serious concerns arise for when personalised profiling linked to e-shopping goes mainstream. Who controls the massive amount of data being collected, who owns it, and what is being done with it? “The customer experience is fast becoming the new currency”, claims Gartner.

35 So your preferences could already be up for sale somewhere to the highest bidder. What if the profiling of people is based on race, social economic status, or sexuality? And what happens to the small food stores and local markets that can’t afford to dive into artificial intelligence?

Making digital agriculture work for people?

Farmers, both small and large, are already using new digital technologies. As the advertisements go “there are multiple ways that these technologies could be harnessed to make food systems better for everyone. Who could be against farmers learning more about the fertility of their soils and the health of their crops with an app on their phone? Or services that provide a more direct connection to the markets and consumers to sell produce to?” The problem is, who controls the data and who gives the advice? This is on top of important questions about how secure these evolving systems are for users and how they might facilitate corporate collusion, tax evasion and other crimes. Apart from these issues, we also need to address the impact of the digital technologies themselves, and how they affect local farmers knowledge and practices.

There are quite a number of initiatives that aim to break with the dependence on high-tech and corporate controlled digital services that are now being pushed upon farmers. One is “FarmHack”, a worldwide community of farmers that build and modify their tools and share information around this freely on-line. Some new IT companies are driving a shift towards crowd-sourced, non-proprietary exchanges of information and research, not only within local communities but with small producers and processors facing similar conditions around the world, for example on pest control techniques.

Over the past decade, numerous farmer-to-farmer networks have sprouted up across the world to share information and advice, many of them using digital tools to communicate. A recent example of how farmers used digital tools to get their products to consumers was when the COVID-19 crisis led to official food distribution channels to be cut off. In many places around the world, farmers went online through social media or e-commerce tools to organise alternative markets. In Karnataka, India, farmers started using Twitter to post videos of their produce and connect with buyers. Others resuscitated traditional systems of bartering, to overcome their lack of cash and match supply with demand.

In Brazil, with the closing of open-air markets and the concentration of food distribution to large supermarkets- where small farmers do not have direct entry- the small farmers movement MPA organised a distribution system with a taxi drivers' cooperative and a group of consumers. This system operates digitally via WhatsApp and a webpage with a weekly menu of available items. Today, the so-called “infobasket” reaches an average of 300 food baskets weekly, especially fresh food, reaching about 3,000 consumers in Rio de Janeiro and surroundings. About 40 “Peasant Production Units” organise the logistics.

These are all excellent locally driven initiatives that deserve our full support. The question is whether they can withstand the onslaught of the platforms and services that corporations are now developing and rolling out, which are all highly biased towards industrial agriculture. As we have seen in this report, they favour the use of chemical inputs and costly machinery, as well as the production of commodities for corporate buyers not local markets. They encourage centralisation, concentration and uniformity, and are prone to abuse and monopolisation. As such, they will only drive us deeper into the multiple crises afflicting the global food system.

This corporate take-over of digital agriculture must be resisted, everywhere. For this to happen, food producers (farmers, fisher people, small retailers, street food sellers, farm workers and others) need to work together with others to break up the power of Big Tech and its billionaires and to fight for a different vision; one based on a democratic and diverse participation in the production and sharing of knowledge and information.

**********

Table 1. Companies and institutions moving into digital agriculture

World's biggest digital technologies corporations involvement in digital agriculture |

Microsoft | Developed FarmBeats project that offers an array of technology controlled through Microsoft cloud for ‘data-driven’ farming which monitor and analyse the condition of soils, water, crops, climatic data, up to date weather data. Microsoft 4Afrika initiative with AGRA to build technology-based solution for agriculture in Kenya, Nigeria, Rwanda, Ghana, Tanzania, Uganda, Malawi and Ethiopia.

|

Apple | Collaborates with Agworld to develop precision farming; Apple watch that works to centralise farm management giving agronomic info and crop history of the field; snapshots of the farm financials; notifications with the recommendations of the farm agronomists; and information when field is ready for harvest. Agworld Apple watch available in USA, Australia, New Zealand, South Africa and Chile. Apple also issued Resolution app, a cloud based farm management software which contains a farm map to record and store day to day events or tasks on farm.

|

Amazon | |

Facebook | Invested 5.7 billion US$ in Reliance Jio, India’s largest mobile network operator. Jio launched a farmer-centred mobile app, Jio Krishi,in 2020. It provides smallholders with advice on precision farming techniques and assists them with making data-driven decisions on things like planting, irrigation, and pest control.

|

Google | |

Alibaba | Leads the offline and online merger of food retails with 12.7 billion US$ investment in physical stores and in the process for acquiring French retail Auchan's operator for another 3.6 billion US$. Acquired 57% of shares at Milk New Zealand Dairy to ensure over 9,500 litres of milk weekly for online sale to China.

|

World's biggest agrochemical corporations involvement in digital agriculture |

Syngenta/ ChemChina | Syngenta bought Cropio in 2019, a digital platform company, to advance its work towards digital farming. Combined, more than 40 million hectares globally will be managed using a Syngenta digital tool, and planned to double this by the end of 2020.

|

Bayer/Monsanto | Bayer has Climate FieldView, courtesy of Monsanto and climate.com that they acquired a couple of years ago.

|

BASF | BASF has Xarvio: helps identifying weeds, diseases, insects, etc. in the field and predicts when they become a problem and advises when to spray or fertilise. BASF is now setting up a joint venture with tech giant Bosch to advance digital farming.

|

Corteva | Corteva has Granular "From each seed to every field, Granular gives you the tools to meet challenges across your entire operation"

|

FMC | FMC Corp. has announced the launch of Arc farm intelligence, an exclusive precision agriculture platform that they claim enables growers and advisors to more accurately predict pest pressure before it becomes a problem.

|

International institutions involvement in digital agriculture |

AGRA | Microsoft partners with AGRA to support digital transformation in agriculture. Part of Microsoft's 4Afrika initiative. "We very much appreciate the opportunity to draw on Microsoft’s digital architecture support on digital ecosystems and big data platforms,” says Vanessa Adams, Vice President, Strategic Partnerships and Chief of Party at AGRA.

|

CGIAR | |

FAO | Google and FAO launched new Big Data tool for all. "I am convinced that transforming our food systems to feed the world will be achieved with digital agriculture" said FAO Director-General QU Dongyu.

|

World Bank | Worldbank funds multiple digital farming initiatives. Their take: "Digital technologies can significantly reduce the costs of linking sellers and buyers; reduce inequalities in access to information, knowledge, technologies and markets; help farmers make more precise decisions on resource management by providing, processing, and analyzing an increasing amount of data faster; and potentially reduce scale economies in agriculture, thereby making small-scale producers more competitive."

|

|

|