The world is spiralling into another profound economic crisis. The last one a decade ago, which was caused by a collapse of the financial sector, triggered a global rush for farmland, as pension funds, private equity boutiques and billionaires sought refuge from tanking stock markets by speculating in so-called natural resource assets. Big players like the US pension fund manager TIAA2 and Sweden's national pension plan shifted hundreds of millions of dollars into new farmland funds. But of the many financial houses suddenly looking for farmland, none was more aggressive than Harvard University's US$40 billion endowment fund.

In an eight year period following the 2008 crisis, Harvard poured over US$1 billion into amassing a global portfolio of farmlands, covering nearly 1 million hectares across the United States, Brazil, Eastern Europe, South Africa, New Zealand and Australia. Harvard's farmland strategy took it deep into some of the most conflictual places on the planet when it comes to land and the environment.

Brazil was Harvard’s preferred target. It established three offshore structures, operating through three different Brazilian agribusiness operators, to buy Brazilian farmland. By 2016, these three structures had amassed over 40 rural properties covering approximately 405,000 hectares, an area twice the size of all the farmland in the US state of Massachusetts (see Box 1: The structure of Harvard's Brazilian farmland operations).

Insolo

Brazilian auto parts magnate Ivoncy Ioschpe is said to have learned about the potential for making money from agriculture in the Cerrado in 2000. He soon started acquiring farmland in the northern state of Piauí and contracted a group of local agronomists, who had formed a company called Insolo, to convert these lands into massive soybean and cotton plantations. In 2008, Ioschpe took over Insolo, placed his son Salomão in charge, and remade the company into a vehicle for channelling money from Harvard's endowment fund into the acquisition of large areas of farmland in Piauí. This company, now named Insolo Agroindustrial S/A, is 95.8% owned by Harvard, by way of its fund management company Phemus Corporation and several subsidiaries in the US state of Delaware and in Brazil. Between June 2008 and June 2016, Harvard injected at least US$138.7 million into Insolo Agroindustrial S/A, which then acquired at least six farms covering over 115,000 hectares in Piauí. Harvard also paid a company connected to the Ioschpe group US$3 million a year in consultancy fees for "investment services", from June 2009 to June 2017, and US$4 million from June 2017 to June 2018.

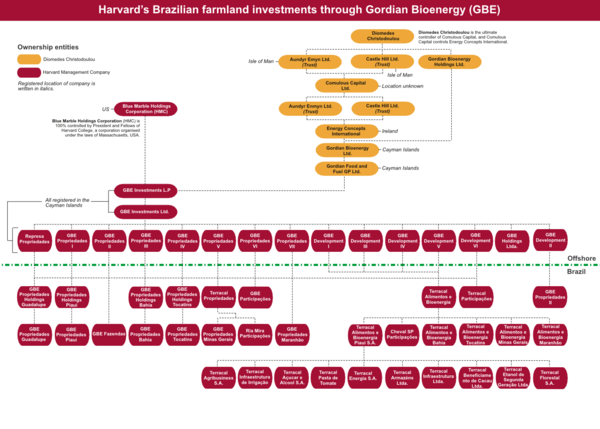

Gordian Bioenergy, known as GBE, is a private equity company run in part by Greek-Brazilian businessman Diomedes Christodoulou, the former CEO of Enron’s South American operations, as well as several of his former Enron colleagues: Roberto Hukai, John Novak and Steven Madrid. In 2007, Christodoulou and his team went looking for US and European investors to back a US$150 million sugarcane plantation and ethanol refinery project they were planning to build in Brazil. They connected with the Harvard endowment and the two sides set up a corporate structure, running through a Cayman Islands company, to channel money from Harvard into the venture. GBE and its subsidiary Terracal then set about acquiring farmland in and around the town of Guadalupe in Piauí, where it proposed to build its sugarcane operations as well as a large-scale tomato farm. Lands were also acquired in neighbouring states for similar large plantation projects. Between June 2008 and June 2015, Harvard transferred over US$246 million to GBE for farmland acquisitions.

Granflor/Caracol

Harvard's entry into Brazilian agriculture was preceded by investments in timber. Some of these deals were orchestrated by two Brazilian businessmen from the forestry sector: Romualdo Maestri and Victor Hugo Silveira Boff, who are the co-founders of the company Granflor Agroflorestal. In 2008, Harvard and these two businessmen established a company in the Brazilian city of Porto Alegre called Caracol Agropecuaria. This company, 100% owned by Harvard through a set of subsidiaries that are registered in the US state of Delaware, received over US$60 million from Harvard's fund management company Blue Marble Holdings between June 2008 and June 2016 for the acquisition of farmland, primarily in the state of Bahia. During this same period, Harvard appears to have paid Maestri and Silveira Boff over US$10 million for investment services through their company Mb - Gestão e Projetos.

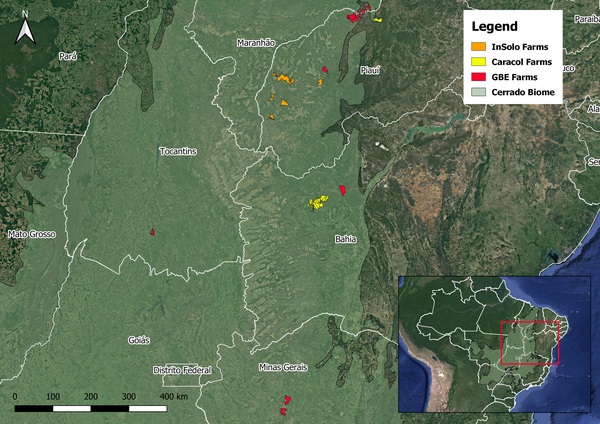

Map of Harvard's farmland acquisitions in Brazil. Courtesy of AidEnvironment

Map of Harvard's farmland acquisitions in Brazil. Courtesy of AidEnvironment "We used to live off of fishing and farming. I can still remember the smell of rice when it was being harvested. But now we can no longer grow our crops".

These are the words of a resident of Arthur Passos, a rural community in the north-eastern Brazilian state of Piauí, speaking in October 2019.8 Ten years ago, they gained official recognition as an Afro-descendent community (quilombola), with special protections under Brazilian law, and with this they began a process to secure official title over their territory. But in 2013 that process was dramatically interrupted.

A powerful company, owned by Harvard University's endowment fund, moved in and claimed all the area surrounding the villagers' homes. The company, Terracal – a subsidiary of another Harvard-owned company, Gordian Bioenergy – erected a 17 km fence and hired security guards to keep people out. The people of Arthur Passos could no longer hunt, fish, grow crops, graze their cattle or collect fruits, medicinal plants and firewood from the forest as they had always done.

Terracal cleared forests from the land and was preparing to move ahead with a massive irrigated plantation project covering 45,000 hectares. Late in 2015, however, Harvard suddenly pulled the plug on the project and withdrew a planned US$350 million investment. The University directed its Brazilian managers to sell the property as fast as possible.9

Harvard, it seems, has yet to find any buyers and the lands have lain idle for the past five years. The only company presence is its security guards, who are there to keep the villagers of Arthur Passos – whom the company describes as "squatters" – from returning to the lands they are desperate to farm once again.

Sign and gate at the Harvard-owned farmlands in Piauí indicating that villagers from Arthur Passos and other communities are prohibited from entering the land for hunting, fishing or collecting firewood – Credit : Daniela Stefano/Rede Social de Justiça e Direitos Humanos The Baixão do Aleixo community in the neighbouring north-eastern state of Bahia is in a similar situation. Harvard's Terracal subsidiary moved into their territory in 2010, when it bought a contested title to a large parcel of land from a wealthy Brazilian family. Since then, there's been a tense conflict between Terracal and the villagers who have used the land to graze their cattle for generations.10

Sign and gate at the Harvard-owned farmlands in Piauí indicating that villagers from Arthur Passos and other communities are prohibited from entering the land for hunting, fishing or collecting firewood – Credit : Daniela Stefano/Rede Social de Justiça e Direitos Humanos The Baixão do Aleixo community in the neighbouring north-eastern state of Bahia is in a similar situation. Harvard's Terracal subsidiary moved into their territory in 2010, when it bought a contested title to a large parcel of land from a wealthy Brazilian family. Since then, there's been a tense conflict between Terracal and the villagers who have used the land to graze their cattle for generations.10

The company has been ruthless in its tactics. Villagers say people hired by the company offered them bribes, deliberately set neighbours against each other, and threatened and intimidated people with violence.

"We were watching wondering from one hour to the next when we would be killed", says one of the villagers. "Once we were right in this house here and a car passed by that was full of men armed with guns. They stopped and got out to mark spots on the ground".

Communications between Harvard and its Brazilian managers, made available through a labour court case filed by a former Terracal employee, show that Harvard was aware of the conflict with local villagers at its Bahia property. When the head of the Brazilian operations told senior Harvard fund managers in 2017 that "invasions" were happening on their Bahia property, its Vice President (Legal Risk), Pamela Egleston, asked, "What are we doing to get them out?" To which the Brazilian operations director replied, "We're doing things ... We're talking to the government. We're doing what we always do, you know?"

The people of Baixão do Aleixo have not let up in their struggle to defend their lands. They have challenged the company in court and have protested any effort that the company makes to prevent them from utilising the lands.

All the while Harvard has been trying to find a buyer for these and other properties that Terracal purchased on its behalf. It seems that the University is not interested in farming these lands; it just wants to keep them empty until it can close a sale.

Harvard's sinking boat

"Here's the thing. What terrifies me is that our money is running out, no more money. Every time we get reports from Vitório, more expenses show up. Now we have a woman to whom we owe more than 300,000 reais because she was fired during her pregnancy. We have another fifty thousand from who knows where... I don't know what else will turn up. Our money's running out. Diomedes, what's gonna happen next year when we don't have any more money? Oh, please. I'm terrified. I have 99% of this project. I don't know what I'm gonna do. I'm really losing sleep over it. And I think we all need to think of some pretty smart ways to cut costs where we can, and at the same time sell everything we can, the best way we can. I really don't think at this point that a white knight is going to show up and pay us an incredible amount to buy all our offshores and wipe us off the map. Diomedes, who in the world is going to get on that boat?"

These are the words of Colin Butterfield, head of natural resources investments for Harvard's endowment fund, speaking to Diomedes Christodoulou, the head of Gordian Bioenergy (GBE) and the architect of a ruinous Brazilian farmland scheme for the University. Harvard reportedly lost US$150 million in just one of the various farmland projects that GBE sold to the University in the Brazilian state of Piauí.11

Meeting between the Governor of Piauí Wellington Dias (left) and Diomedes Christodoulou, the head of Gordian Bioenergy, January 2018 - Credit: Andre Oliveira, @siteantigo.pi.gov.br.

Meeting between the Governor of Piauí Wellington Dias (left) and Diomedes Christodoulou, the head of Gordian Bioenergy, January 2018 - Credit: Andre Oliveira, @siteantigo.pi.gov.br.

Christodoulou is a former Enron executive who convinced Harvard's fund managers to bankroll a scheme to acquire huge areas of farmland in remote parts of Brazil's Cerrado region for large-scale farming projects. The top end of the scheme, managed through Gordian Bioenergy and its Brazilian subsidiary Terracal, was structured through a complex web of companies running through tax havens like the Cayman Islands, the US state of Delaware and the Isle of Man.12 (see Organigram of link between Harvard and GBE - click here to zoom in )

Over a period of about five years, GBE and Terracal acquired over 30 farms in five Brazilian north-eastern states for Harvard, totalling 168,000 hectares—an area more than twice the size of New York City.

In 2019, a former employee of Terracal took GBE and Harvard to court and filed a 2,000+ page document of correspondence between executives and managers from Harvard and the various companies involved in the scheme. The document shines a rare light on the inner workings of Harvard's US$40 billion fund.

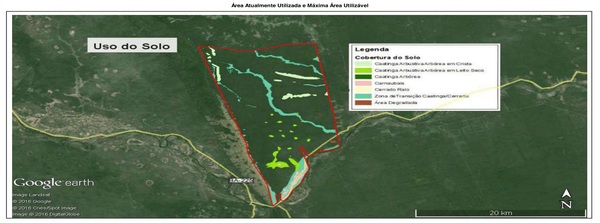

The document makes it clear that Harvard knew about conflicts with local communities living around its farms. It also shows that Harvard was aware that many of the lands it bought were covered in native forest, and that converting these lands to large-scale plantations would cause huge deforestation. For example, maps from a valuation of the Bahia property near Baixão do Aleixo undertaken for Harvard by Deloitte show that the property is completely covered in native vegetation. (see Deloitte's valuation of the Boqueirão farm, Bahia, Brazil, May 2017 - click here to zoom in)

The Deloitte valuation of Harvard’s Boqueirao farm in Bahia states that the farm area (in red) is "entirely covered by native vegetation". As shown on the map, the vast majority of the area is covered in dry forest typical to the region ("Caatinga arbórea”), with some minor parts covered with less forested savannah. Click here to zoom in

The Deloitte valuation of Harvard’s Boqueirao farm in Bahia states that the farm area (in red) is "entirely covered by native vegetation". As shown on the map, the vast majority of the area is covered in dry forest typical to the region ("Caatinga arbórea”), with some minor parts covered with less forested savannah. Click here to zoom in

Terracal was not the only company that Harvard used for acquiring farmlands in Brazil. There were two other operations, run separately through different Brazilian companies: one through Caracol Agropecuária and another through Insolo Agroindustrial.

Caracol acquired around 100,000 hectares of land in Bahia, but has yet to put the lands into production. The property is beset by long-standing land conflicts, and the state prosecutor is reviewing allegations that Harvard's company isn't the rightful owner. In October 2019, however, Caracol received approval from the state authorities to clear over 5,000 hectares of native forest on its property for agricultural purposes.13

Insolo is run by a Brazilian business family that has become one of the largest land owners in Piauí over the past two decades. Some of the lands that they acquired for Harvard, and now operate, are near the Quilombo and Riozinho mountains – alongside the communities of Salto, Morro d'Água and Rio Preto Settlement.

In October 2019, Rede Social de Justiça e Direitos Humanos conducted interviews with local villagers about the impacts of the Harvard-owned farms and other large-scale plantations in the area on their communities. One of the main problems was the heavy use of pesticides and other chemical inputs sprayed on the land by tractors and aeroplanes. The pesticides drift into the community, affecting people’s homes and polluting food production, making them sick and damaging their crops. Because the farms are situated in highland plateaus, the pesticides also pollute their water sources in the valleys.

"All through the rainy season [from October to April] the water from the highlands flows down and fills our streams with agrotoxins", said one villager. "This is the water we consume. Here we have no well, no running water; we drink from the stream and so we drink all the agrotoxins that flow down".

"The water gets muddy, it stinks", said another villager. "In the local river, we see the little fish floating on top of the water, dead. I didn't see the little fish dead before. When we go fishing now, if we go in the morning, it takes us until noon to catch a little fish. There are no more fish in the river because of the poison".

The villagers say that their water sources are also drying up because of the Harvard farms and the other vast farms in the area that use large, central pivot irrigation systems.

"There was a farm here on the side of the Galileia farm, run by Insolo. It deforested 10,000 hectares and then dried up two wetlands", recounted one villager. "Before our cattle couldn't pass through the wetlands because they would get stuck, but now they are grazing inside the swamp. This started about seven years ago. Now there is only water in the rainy season. The deforestation went right up to the edge of both swamps. The Galileia farm is right at the head of the two wetlands and we're afraid that they're now going to drill a well and get more water there".

Land records indicate that Harvard sold the Galileia farm in 2017 to the Brazilian agribusiness company Grupo Peteca, but it appears to still own the other farmlands it acquired through Insolo in the same area.14

The story is similar within the municipality of Santa Filomena, in another part of Piauí where Insolo operates more farms for Harvard. People from the community of Baixão Fechado say the Harvard farms have deprived them of the lands they traditionally used to graze their cattle, and the irrigation systems in Harvard’s plantations are drying up their water sources.

"Before the farms, people used the Cerrado to graze their animals and there was more water too, and now that's over", said one villager.

The Cerrado is the largest and most biodiverse tropical savannah in the world, a vital storehouse for carbon dioxide, as well as the “birthplace of waters”, where most of Brazil’s major river systems originate. But in recent years it has become the main frontier for the expansion of large-scale industrial plantations in Brazil. Over the past decade, the area has seen 50% more deforestation than the Amazon, with the loss of over 10 million hectares of native tree cover.

Evidence of fires at Fazenda São Pedro, one of the properties that form part of Harvard's large farmland agglomeration in Guadalupe, Piauí, October 2019, Credit : Daniela Stefano/Rede Social de Justiça e Direitos Humanos

Evidence of fires at Fazenda São Pedro, one of the properties that form part of Harvard's large farmland agglomeration in Guadalupe, Piauí, October 2019, Credit : Daniela Stefano/Rede Social de Justiça e Direitos Humanos "The forest reserve of [Insolo's] Galileia farm is all burnt. The reserve they left, in the lowlands, everything was burned", said one Baixão Fechado resident, speaking about the section of the former Harvard farm property that the company was legally obliged to protect as a reserve and not clear for farming. "I don't know if they set the fire themselves, with bad intentions, or if the fire came from somewhere else ... Every year it gets hotter and when there's a fire it's not controlled anymore". Some residents near the farms Insolo operates say that the company's heavy use of pesticides is also contributing to the increasing damage from fires.