Fifty years ago you would be hard pressed to find foods made with palm oil unless you were in Central or Western Africa where the crop originates from. Today it's hard to avoid it. Palm oil is everywhere, especially in processed foods. Studies suggest it is contained in about half of the packaged foods on supermarket shelves, whether you are shopping in Shanghai, Durban or Santiago.1 You'll also find it in most soaps, cosmetics and lotions.

The demand for palm oil is insatiable. Consumption has increased by about 1.5 million tonnes per year since the mid 1980s, going from just a few million tonnes to over 50 million tonnes today. Palm oil now accounts for over half of the world's total consumption of oils and fats.2

The underlying reason for the dramatic boom is simple: palm oil is cheap. Amongst the big crops for oils and fats (oil palm, soybeans, oilseed rape and sunflower), palm oil is the cheapest.3 So wherever there's a demand for a cheap, generic source of vegetable oil, palm oil tends to win out.4

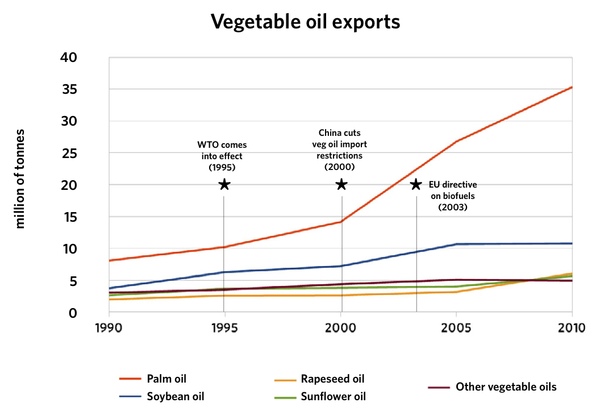

This wasn't always the case. Not long ago, national markets for vegetable oil were dominated by local sources of oils and fats and national policies and regulations protected domestic vegetable oil producers from cheap imports. But, over the past 15 years, the World Trade Organisation (WTO) and a series of bilateral free trade agreements have removed most of these protections, opening the flood gates to vegetable oil imports.

Malaysian palm oil companies jumped on this opportunity. They expanded production, first in Malaysia and then in Indonesia. Other companies followed suit. Today, Malaysia's forests and agricultural lands are carpeted with oil palm plantations, as are several islands of the Indonesian archipelago. These two palm oil powerhouses now account for around 90% of global palm oil production and exports, a huge figure considering that palm oil accounts for nearly two thirds of total global vegetable oil exports.

The surge in palm oil exports has hit farmers hard in importing countries, such as India. During the 1980s and early 1990s, the Indian government used import restrictions and government programmes to maintain national self sufficiency in vegetable oil production. Decent prices encouraged farmers to expand into oilseeds and boost production of traditional vegetable oil crops, like coconut, whose production doubled in the first half of the 1990s. The local processing of the oils also generated thousands of jobs.

But in 1994, under pressure from the World Bank and as part of its WTO obligations, India started eliminating restrictions on vegetable oil imports. The country was immediately inundated with imported palm oil, while production of traditional oil crops languished. Today, with tariffs on palm oil fluctuating around zero, India is the world's largest importer and consumer of palm oil.5

The high cost of cheap palm oil for India's coconut farmers

The high cost of cheap palm oil for India's coconut farmers

Shanmugam is a coconut farmer in Talavady, Tamil Nadu. The flood of imported palm oil into India has driven down the price for coconut paid to Shanmugam and other farmers, deeply affecting their livelihoods. "Farmers are drowning in debt, and we're trying to survive in anyway we can,” says Shanmugam. “The coconut price is only 4-5 Rs per nut, which is what it was 20 years ago, and we can't even afford to harvest or remove the coconut trees now to change to other crops because it's too costly."

This year Shanmugam is selling his 7 hectare coconut farm to pay off a portion of his debt.

China has followed a similar path. Imports of oil palm hovered around 1 million tonnes per year until China made significant cuts to import restrictions in 2000 as part of its WTO entry obligations. Imports ballooned, reaching 5 million tonnes per year by 2005. That year, China began implementation of a free trade agreement with the Association of Southeast Asian Nations, which the Malaysian oil palm industry credits with a further 34% increase in oil palm imports between 2005-2010.6

The world's fourth largest import market for palm oil, Pakistan, is also a product of free trade. The Malaysian palm oil industry says the 2008 Malaysia-Pakistan free trade agreement is responsible for doubling Pakistan's palm oil imports between 2007-2010.7

China, India and Pakistan were marginal consumers of palm oil two decades ago. Today they account for over 40% of total global imports, and a third of global consumption.8

Trade policies are not the only factor however. The surge in palm oil imports in India and China, and in many other countries in the South, such as Venezuela and Bangladesh, also correlates with major transformations to their food systems. Global food corporations, restaurant chains and supermarkets are expanding rapidly in the South and this is increasing the consumption of processed foods. Annual sales growth of processed foods is around 29% in low and middle income countries, as opposed to only 7% in high income countries.9

More consumption of processed foods means more consumption of fats, and more consumption of palm oil, the world's discount source of fats. It is estimated that palm oil is found in half of all packaged foods on supermarket shelves.10 In China, where supermarkets are expanding faster than anywhere else on earth, the annual per capita consumption of vegetable oils has gone from 3 kg in 1980 to 23 kg in 2009, or roughly 64 grams per day-- almost twice the fat intake required to meet a person's nutritional requirements. Palm oil now accounts for a third of the vegetable oil consumed in China, nearly three times the share it held in 1996.11

In Mexico, sales of processed foods have increased by 5-10% per year since the country began implementing the North American Free Trade Agreement with the US and Canada, opening the door to increased foreign investment by multinational food companies.12 Obesity rates are soaring; Mexico now has a higher percentage of obese people than the US. And palm oil consumption is soaring too. Per capita consumption of palm oil doubled from 1996, when it accounted for 11% of the vegetable oil in the average Mexican's diet, to 2009, when it accounted for 28%.13

Even in the US, there has been a recent shift by food companies towards the use of palm oil, partly in response to concerns over transfats. Since 2000, consumption of palm oil in the US has grown nearly sixfold.14

This is still well behind Europe, where consumption totalled 5.8 million tonnes in 2012, double what it was in 2000. Growth of palm oil consumption in Europe is, however, driven less by changes to the food system, as it is by the continent's biofuel policies. The implementation of biofuels mandates in European countries over the past decade or so has created much greater demand for palm oil, both as a feedstock for biodiesel and as a vegetable oil to replace European oilseeds that are diverted to biofuel production. Palm oil imports could surge much further if a European Commission proposal goes forward which would see all 27 members of the European Union requiring biofuels based on food crops to account for at least five percent of national transport fuel consumption The legislation would require an additional 21 Mtoe (million tonnes oil equivalent) of biofuels by 2020. Measured in palm oil, this equates to roughly 5.5 million ha of new oil palm plantations.15

Notes

1 RSPO, "Why palm oil matters in your everyday life," 2013

2 IEA Bioenergy, "A global overview of vegetable oils, with reference to biodiesel," 2009; Sime Darby, "Palm oil facts & figures," 2013

3 Sime Darby, "Palm oil facts & figures," 2013

4 GRAIN thanks Pastor Adjahossou Firmin, resource person on palm oil from Benin, for his contributions.

5 Afsar Jafri, "Trade Liberalisation's Impact on Edible Oil Sector in India," Focus on the Global South, 6 July 2011

6 N Balu and Nazlin Ismail, "Free Trade Agreement –The Way Forward for the Malaysian Palm Oil Industry," Oil Palm Industry Economic Journal (11.2)

7 N Balu and Nazlin Ismail, "Free Trade Agreement –The Way Forward for the Malaysian Palm Oil Industry," Oil Palm Industry Economic Journal (11.2)

9 Corinna Hawkes, "Globalization and the Nutrition Transition: A Case Study", in: Per Pinstrup-Andersen and Fuzhi Cheng (editors), "Food Policy for Developing Countries: Case Studies," 2007

10 Rainforest Action Network, "Conflict palm oil," September 2013

11 Dinesh C. Sharma, "Rise in oil consumption by Indians sets off alarm," India Today, 2 April 2012; FAOSTAT

12 Corinna Hawkes, "Globalization and the Nutrition Transition: A Case Study", in: Per Pinstrup-Andersen and Fuzhi Cheng (editors), "Food Policy for Developing Countries: Case Studies," 2007

13 FAOSTAT

14 Rainforest Action Network, "Conflict palm oil' September 2013

15 GRAIN, "Land grabbing for biofuels must stop," February 2013